Faces of Cotton: Veterans Day Edition

Photo credit for header image: Orin Romine.

By Kara Bishop

Today, we dedicate our Cotton News newsletter to the men and women who have served, fought and protected our country. In honor of Veterans Day, we share stories of those who served our country and also serve our cotton industry.

Kirby Lewis – Cotton Farmer

Kirby Lewis with his grandparents after flying into Reece Air Force Base in Lubbock, Texas, on a TA-J4 Skyhawk aircraft.

U.S. Navy – Naval Aviator/Flight Instructor

1981-1991

Kirby Lewis farms cotton in Floyd, Hale and Lubbock Counties. But in a different life, he served as a naval aviator for 6 years, 9 months and 15 days.

“I remember the exact amount, because it was required for my application to Laughlin Air Force Base, where I spent four years with the 96th Flying Training Squadron.”

He joined because he wanted to experience landing on an aircraft carrier. “I didn’t realize I’d have to live on it. An ocean carrier can get crowded with 5,000 airmen and sailors packed in it for a six-month tour.”

After graduating from Texas Tech University with an agricultural engineering degree, Lewis went on to fly E-2C Hawkeyes with Carrier Air Wing 9. “I had 2,100 flying hours by the time I completed two tours on aircraft carriers.”

He went on to fly T-2C Buckeyes as an instructor with Training Wing 3 at NAS Chase Field in Beeville, Texas for another 1,500 flying hours.

He now farms with his son, which he said he wouldn’t trade for the world.

“I think if everyone had military service experience, this country wouldn’t be as divided as it is today. There’s nothing more unifying than serving together as Americans for America.”

Randy West – Assistant Manager, Long S Gin

Army Sergeant First Class

1987-1997

Everyone in Randy West’s family has served in the military. His grandfather retired after 36 years of service; his father served in the U.S. Coast Guard; his oldest brother served in the U.S. Navy; his little brother was in the U.S. Army; and his son served 12 years in the U.S. Navy.

“After his service, my dad was a Baptist preacher, and I was a rebel child. I don’t know where I’d be if it weren’t for the Army — you grow up quick in the service.”

West fought in Desert Storm, spending five months stationed in Kuwait. “There are some things you just don’t talk about. Some things I don’t want to think about.”

West has two module truck drivers, Jose Hierro, who served in the U.S. Marine Corps, and Norman Grayson, who served in the U.S. National Guard, and PCG thanks them for their service.

“I learned honor, trust, work ethic and selflessness during my service. It’s not about you anymore when you’re in the military. I went from a selfish high school kid to a changed adult, which is why I believe everyone should go through basic training right out of high school.”

Travis Broiller

Travis Broiller and his wife, Stephanie. Photographer: Teala Ward.

U.S. Marine Corps

2004-2008

Travis Broiller joined the U.S. Marine Corps right out of high school, motivated in part by 9/11 and in part by his grandfather, who also served as a Marine.

“I don’t think people understand the mental toll it takes on a person to serve in the military.”

Broiller deployed to Iraq for two years as a Marine. When he came back and enrolled in college, he felt lost. “I had trouble finding purpose outside of the service, so I dropped out of college and went back as a contract worker for a security company.”

Another three years in Iraq and Broiller was ready to come back home. Growing up in an agricultural community and heavily involved in FFA, Broiler knew he wanted to farm. He custom farms in the Clarendon, Texas area.

“You grow up quickly in the service. I learned loyalty, commitment, dependability, but above it all, I learned to be on time.”

Thank you to our men and women who serve to fight, defend and protect our great nation.

Crop Progress/WASDE Report Highlights

U.S. Crop Progress

For the week ending Nov. 6, 2022, the USDA Crop Progress report shows 62% of the U.S. cotton crop has been harvested — up seven percentage points in the last week, as well as seven percentage points ahead of the five-year average for early November.

All 15 cotton-producing states are showing harvest numbers ahead of their respective averages, according to Jim Steadman with Cotton Grower. The biggest jumps in harvest during the past week came in Missouri (up 24 points), Oklahoma (up 16 points) and Kansas (up 15 points). Alabama, Georgia and North Carolina all reported 11-point increases.

WASDE Report Highlights

The U.S. Department of Agriculture (USDA) World Agricultural Supply and Demand Estimates report indicated little change in the cotton outlook. Here are the highlights:

The 2022/23 U.S. cotton crop balance sheet shows slightly higher production and higher ending stocks for the month of November.

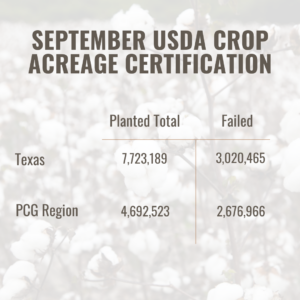

- Production is projected 1.5% higher at 14 million bales as a decrease in the Southwest is more than offset by increases elsewhere.

- Domestic mill use and exports are unchanged; ending stocks are 200,000 bales higher at 3 million bales or 20% of use.

- The 2022/23 season average price for upland cotton is reduced 5 cents this month to 85 cents per pound.

The global cotton crop balance sheet shows lower production, consumption, trade and ending stocks.

- Production is down 1.6 million bales from last month, led by a 700,000-bale cut in Pakistan’s crop due to extension damage from flooding earlier in the production season.

- Unusually high rainfall in Australia has reduced their crop by 500,000 bales also. This precipitation, in part, accounts for a 630,000-bale decline in West Africa’s expected output as well.

- Global consumption is projected 650,000 bales lower with a 300,000-bale cut to mill use in both Pakistan and Bangledesh.

- World trade is 400,000 bales lower — import reduction for Bangladesh and China only partly offset by Pakistan’s increase.

- West African exporters account for most of the decline in projected exports.

- At 87.3 million bales, world ending stocks in 2022/23 are projected to be 600,000 bales lower than in October, but 1.6 million higher than the year before.

2022 Cotton Quality Summary

The following is a summary of the cotton classed at the Lubbock and Lamesa USDA Cotton Division Cotton Classing Offices for the 2021 production season.

- Avg. Daily Receipts

- Avg. Daily Classed

- Carryover (Bales)

- % Classed (Estimated)

- Bales

- Color (%)

- Leaf

- Staple

- Mike

- Strength

- Uniformity

- Bark (%)

Lamesa: 2,002

Lubbock: 15,667

Lamesa: 2,008

Lubbock: 14,907

Lamesa: 2,511

Lubbock: 23,450

Lamesa: 10.7

Lubbock: 19

Lamesa: 10,053

Lubbock: 104,347

Lamesa:

21+ – 62.4

31 – 26.2

12 – 0.1

Lubbock:

21+ – 46.4

31 – 38.9

12 – 2.5

Lamesa: 2.38

Lubbock: 3.08

Lamesa: 36.79

Lubbock: 37.02

Lamesa: 4.42

Lubbock: 4.10

Lamesa: 30.74

Lubbock: 31.43

Lamesa: 81.08

Lubbock: 81.10

Lamesa: 7.9

Lubbock: 16.5

Season Totals to Date

Lamesa: 19,855

Lubbock: 199,579

Lamesa:

21+ – 59.8

31 – 29.7

12 – 0.1

Lubbock:

21+ – 54.9

31 – 26.7

12 – 6.1

Lamesa: 2.36

Lubbock: 2.83

Lamesa: 36.51

Lubbock: 36.89

Lamesa: 4.40

Lubbock: 4.14

Lamesa: 30.60

Lubbock: 31.44

Lamesa: 80.81

Lubbock: 80.96

Lamesa: 8.1

Lubbock: 13.7

Our 109th Election

By Kody Bessent

The U.S. House of Representatives has been an elected and eclectic body with its membership reconstituted every two years throughout its history. The biennial term was a compromise at the Federal Constitutional Convention in 1787. The U.S. Senate, following the ratification of the Seventeenth Amendment in 1913, marked the first time since the inception of our democracy that elections were held by popular vote.

Elections are unique, and we are very fortunate and blessed to be able to exercise our right as a citizen to cast a vote toward whom we believe is best fit to serve our interest and needs for our local, regional and state communities and economies.

November 8, 2022, marked the 109th election that has been held by the U.S. to dually elect our representatives in the House and Senate by popular vote — the mid-term, which occurs two years after each presidential election. Elections are held for all 435 seats in the House of Representatives, and traditionally 33 or 34 seats in the Senate are in play. As a result, the membership of these two legislative chambers changes near the midpoint of a president’s four-year term of office.

Historically, the House and, at times, the Senate recreates itself after every election —pending bills expire, committee work is shelved, and new Members take their seats. Even if few new legislators win election and the party in control of the House or Senate remains the same, each session forms its own identity.

While the 2022 midterm elections are not conclusive, a balance of power is presumptively on the horizon. As of press time, according to the Associated Press, House Republicans have secured 211 seats while Democrats have retained 192, leaving 32 seats still yet to be decided. 218 seats are what is needed to serve as the majority in the House. If the balance of power shifts from the current Democratic majority to Republicans in the House, we predict Congressman G.T. Thompson (R-Pa.) will assume the helm of the House Committee on Agriculture and will serve as Chairman during the development of the 2023 Farm Bill.

Likewise, the Senate Republicans have secured a total of 49 seats (29 seats are not up for re-election) while Senate Democrats hold 48 seats (36 seats are not up for re-election). A runoff in the Georgia senate race between Raphael Warnock (D) and Herschel Walker (R) will be held December 6th. If Republicans win the majority in the Senate (still yet to be determined) we expect Sen. John Boozman (R-Ark.) to be the next Chairman of the Senate Committee on Agriculture and would serve in that capacity during the development of the next Farm Bill.

In general, Texas will have seven new Members in the House of Representatives following this election. Neither U.S. Senator John Cornyn or Ted Cruz was up for election this cycle. Statewide elected officials such as Governor Greg Abbott, Lt. Governor Dan Patrick, Attorney General Ken Paxton, Texas Comptroller Glenn Hegar and Commissioner of Agriculture Sid Miller all prevailed in their re-election bid.

We look forward to working with leadership in the next Congress to secure adequate farm policy that helps address issues such as disaster, supply chain challenges, rising input costs, and infrastructure needs.

Prior to Election Day, 5,509,094 individuals had cast their vote with a total of 17,672,143 registered voters in Texas.