Welcome to the April 14, 2023 issue of Cotton News, a service provided by Plains Cotton Growers Inc. for the cotton industry in the Texas High Plains and beyond.

More Rain or More Indecision?

Easter Sunday brought rain (and hail) to Lubbock County and other parts of the Panhandle and Southern High Plains, breaking a 46-day dry streak as Lubbock and surrounding areas hadn’t seen rain since Nov. 26, 2022.

rain since Nov. 26, 2022.

Unfortunately, the hail that came with the weather event was the final nail in the coffin for some of the area’s winter wheat crop. Many producers in the area had considered bringing a wheat crop to harvest due to attractive wheat prices when compared to cotton. However, drought and hail will cause most to bale it instead, according to PCG Director of Field Services Mark Brown. “Wheat hay is selling for $200 per ton, which boggles my mind, so a lot of it will be baled and I’ve also heard of some chopping it for wheatlage.”

As far as rain in the 10-day forecast is concerned, Brown commented, “There’s not much of a chance, but there is a chance.”

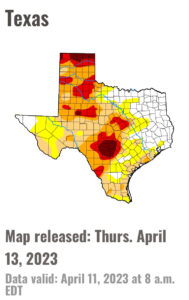

The U.S. Drought Monitor for the state of Texas April 13, 2023, indicates majority of PCG region still in heavy drought despite Easter Sunday rain.

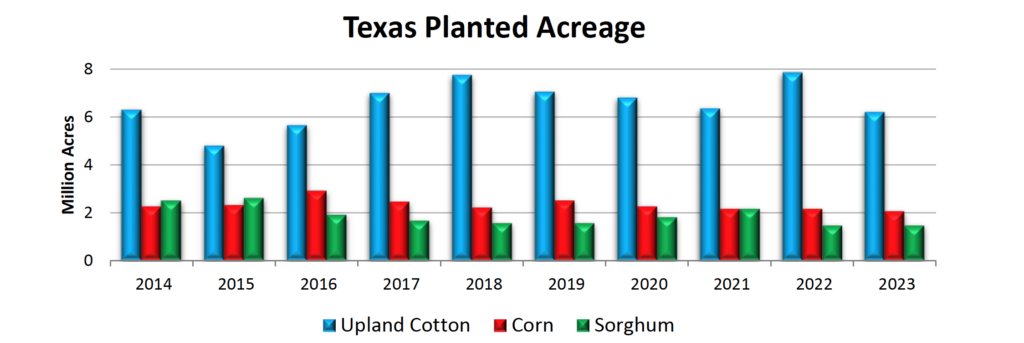

The lack of demand tanking cotton prices combined with continued drought with little relief has many producers still undecided on planting intentions across the High Plains. Ken Legé, Ph.D., cotton development specialist for Phytogen, supported this statement estimating that seed bookings for all brands are two to three weeks behind the normal time frame for the coming crop year.

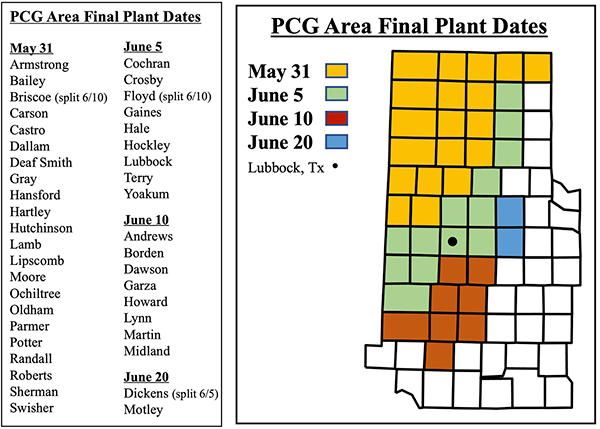

While those south of Interstate 40 are limited in planting options, producers in the Panhandle may plant more sorghum and corn silage this coming season. Attractive silage contract prices from dairies will heavily compete with northern acres this year.

However dryland farmers along the southern high plains may look to plant sorghum as its insurance coverage is more favorable in many cases. “Growers are very reluctant to commit to cotton for dryland acres,” Legé added. “While we suspect most of them will go to cotton, it will be more of a last-minute decision.”

While we all sit on the edge of our seats waiting ultimate decisions from producers, many industry veterans are experiencing déjà vu.

“We don’t give up because we’ve seen this exact scenario many times,” said Brent Nelson, PCG chairman and producer in Lamb County. “I’ve seen it turn around and I’ve also seen promising crop years turn out bad, so I guess I would say, ‘stay tuned.’”

Market Outlook

Cotton prices have been stuck in the 81- to 84-cent range over the last few weeks and seem content there. Expectation of that changing is hard to predict today.

“This is just my opinion,” said Darren Newton, Southwest Cotton Buyer for Viterra USA Agriculture, LLC. “It could take some time to get deeper into planting, new crop supply and the situation in West Texas to play out before the price may respond.”

In terms of exports, 144,000 units sold this week, which is not as good as prior weeks but still a decent amount sold for this time of year, according to Newton.

“We shipped 335,000 units, which was a great shipment, and that needs to continue as we finish off the crop year over the next 15 to 16 weeks,” he added.

Overall, Newton said basis today for old crop has weakened with the May/July spread moving to even and inverting this week. Currently new crop basis seems to be bid about like last year and will move from that based on each regions crop size and quality expectations. “The market today seems pretty consistent to what we saw last year,” he added.

Rep. Jodey Arrington Joins Spring American Cotton Producers Meeting

Rep. Jodey Arrington (R-Texas), chair of the House Budget Committee, joined the spring meeting for American Cotton Producers (ACP) in Dallas on April 13 and 14.

Pictured: National Cotton Council Chair Shawn Holladay (and PCG board member), Rep. Arrington and ACP chair Nathan Reed, producer in Arkansas.

There he discussed reducing the national debt, while also building a strong, robust farm bill and supporting agriculture as the food and fiber segments are issues of national security.

international operations.

international operations. might impact their personal planting intentions. And, of course, the 14-hour dirt storm on February 26 was part of the conversation.

might impact their personal planting intentions. And, of course, the 14-hour dirt storm on February 26 was part of the conversation.

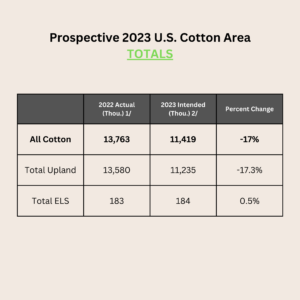

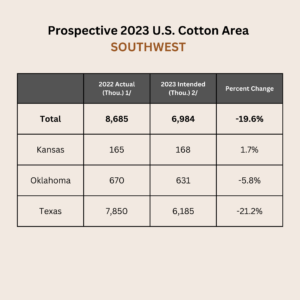

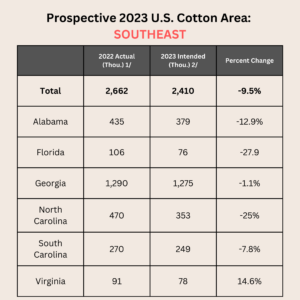

projections provided by Jody Campiche, Ph.D., vice president of Economics and Policy Analysis.

projections provided by Jody Campiche, Ph.D., vice president of Economics and Policy Analysis. 466,000 ELS bales.

466,000 ELS bales. work with the council and government officials to influence policy and legislation favorably for the U.S. cotton industry.

work with the council and government officials to influence policy and legislation favorably for the U.S. cotton industry. “I am honored to continue my representation of the cotton industry in this new role,” Holladay said. “I would like to encourage all associated in this great industry to answer the call to lead. If we are not willing to represent our industry and support our organization, then who will? Our success rests with our willingness to be part of the process.

“I am honored to continue my representation of the cotton industry in this new role,” Holladay said. “I would like to encourage all associated in this great industry to answer the call to lead. If we are not willing to represent our industry and support our organization, then who will? Our success rests with our willingness to be part of the process.