Welcome to the March 10, 2023 issue of Cotton News, a service provided by Plains Cotton Growers Inc. for the cotton industry in the Texas High Plains and beyond.

Cotton Day at the Capitol

The Texas cotton industry convened at the state Capitol for Cotton Day on March 7, 2023, to educate Senate and House members and staff on the importance of Texas’ No. 1 cash commodity crop.

Plains Cotton Growers representatives who attended the proceedings were PCG Chairman Brent Nelson, PCG President Martin Stoerner, PCG Board Member Todd Straley and PCG CEO Kody Bessent. Many Texas cotton industry segments, groups and councils were in attendance, handing out cotton towels to members and staffers with information pertaining to the industry.

In addition, the PCG team met with members to emphasize the need for cotton infrastructure assistance for the 2022 crop year; cotton, wool and mohair research funding; and maintaining funding for the Boll Weevil Eradication Program.

“Back in 2011 when we thought the drought was so bad, my gin produced 47,000 bales,” Todd Straley told Rep. John Smithee (R-District 86). “This last year, we ginned 16,000.”

Sen. Charles Perry (R-District 28) introduced Senate Resolution 268 on the Senate floor, recognizing the great cotton industry in the state of Texas.

“Agriculture is the spirit of West Texas and the spirit of this nation…we want to recognize this industry for what it does for Texas and recognize this day as Cotton Day.”

Meet the Texas House Ag Committee Chair Briscoe Cain

Rep. Briscoe Cain (R-District 128) is the Texas House Agriculture Committee Chair for the 88th Legislature. The legislative session started January 10th and runs through May 29th.

Cain earned his doctorate of jurisprudence from South Texas College of Law and owns and operates the Law Office of Briscoe Cain, PLLC.

While presenting at the Texas Agriculture Council meeting in Austin, Texas, on March 8th, Cain mentioned he was on his second read-through of the Texas Agriculture Code and that he would, “do everything I can to get the government off of your backs so you can thrive.”

While out of session, Cain resides in Deer Park, Texas, with his wife, Bergundi and their five children.

“We appreciate Chairman Cain’s support of our industry, and we look forward to working with him this legislative session,” said Kody Bessent, PCG CEO.

Textile Mill Executive Presents to Plains Cotton Advisory Group

Rehman Naseem, CEO and owner of Fazal Cloth Mills, Ltd. In Multan, Pakistan, presented to the Plains Cotton Advisory Group on March 10, 2023.

Based on his presentation, the challenges facing the textile mill industry include the following:

Supply Disruptions Caused by the COVID-19 Pandemic

Not only was the supply chain broken as complications arose from the global pandemic, but demand skyrocketed. “Certain countries weren’t able to supply the demand,” he said. “Plus shipping of product from destination to the source was disrupted. Retailers were finding it hard to predict when a particular order would arrive so they were ordering more quantity than required due to the level of uncertainty in receiving the goods.” Naseem added that Pakistan was one of the countries that opened earlier than others so its production facilities were able to cash in on this demand. “Cotton consumption in Pakistan shot up to 16 million bales February 1, 2021.”

Inflation

Naseem stated the investment in the textile chain in Pakistan increased in 2021, as everyone expected the demand to remain constant or even increase going forward. Across the industry, from spinning, weaving, production, etc., there was investment in all segments. Unfortunately, inflation caused a different situation in 2022. “The central banks in most countries started raising interest rates and retailers were fearful of a recession and lack of demand as a result, so the focus transitioned to cutting down on inventory.” The second half of 2022, Naseem saw a reduction of capacity by 50% in his mill. China’s retail demand remained very low with their strict COVID policies; though, recently they have started to enter the marketplace. Naseem said his mill is now operating at 70% capacity — Pakistan needs to consume 16 million bales to be at full capacity. Right now, they are expected to consume 12 million bales this year.

Uyghur Forced Labor Prevention Act

Naseem stated this act enforced by the U.S. — along with other countries who imposed their own restrictions on importing goods from cotton grown in the Xinjiang Uyghur Autonomous Region of the People’s Republic of China — has had a negative effect on the textile mill industry as a whole. The restriction policies have put pressure on Chinese cotton prices. For the first time in many years, we are seeing the Chinese cotton price premium for new York futures reduced sharply, trading almost even with New York. Today, it’s trading at 14 to 15 cents above New York, when traditionally — over the last four to five years — China’s cotton price premium has been 25 cents over New York.

“This has a negative impact on our industry because Chinese mills are able to procure cotton at cheaper prices and are exporting yarn at a very cheap price,” Naseem added. “While the U.S. and some parts of Europe are banning Xinjiang cotton, other destinations like South America and Southeast Asia are not. So, a lot of demand has shifted to these cheaper yarns coming out of China. It’s hard for us to compete at this price level, and, once yarn is available at a certain price, the market adjusts to that price, so it’s difficult to ask for a premium.”

Naseem went on to say that he believes this price pressure is one of the main reasons cotton prices remain under pressure. “I expect this will be a critical challenge we will face for another six months until the issue is resolved somehow.”

Naseem’s annual mill use is roughly 450,000 bales per year. He said that Pakistan mills are well covered for the second quarter of the year, but they will need to buy additional cotton in the next six months to get back to 100% capacity. If this happens, he says Pakistan mills will need around three million bales.

The new cotton crop in Pakistan will arrive in August. Naseem acknowledged the tough crop year Pakistan had in 2022 with severe flooding and weather events — ending up with 5 million bales rather than the expected 10 million-plus. “Even during normal production years, Pakistan still imports a net of five to seven million bales per year,” he added. “Almost 20% of all cotton imported is from the U.S.”

Deadlines and Reminders

ARC/PLC Decisions

ARC/PLC decisions must be reported to your local FSA office by March 15.

Conservation Reserve Program Sign-up Dates

General sign up for the Conservation Reserve Program (CRP) will begin February 27 and end April 7.

U.S. Cotton Trust Protocol

March 31, 2023, is the deadline for U.S. cotton producers to enroll their 2023 crop in the U.S. Cotton Trust Protocol.

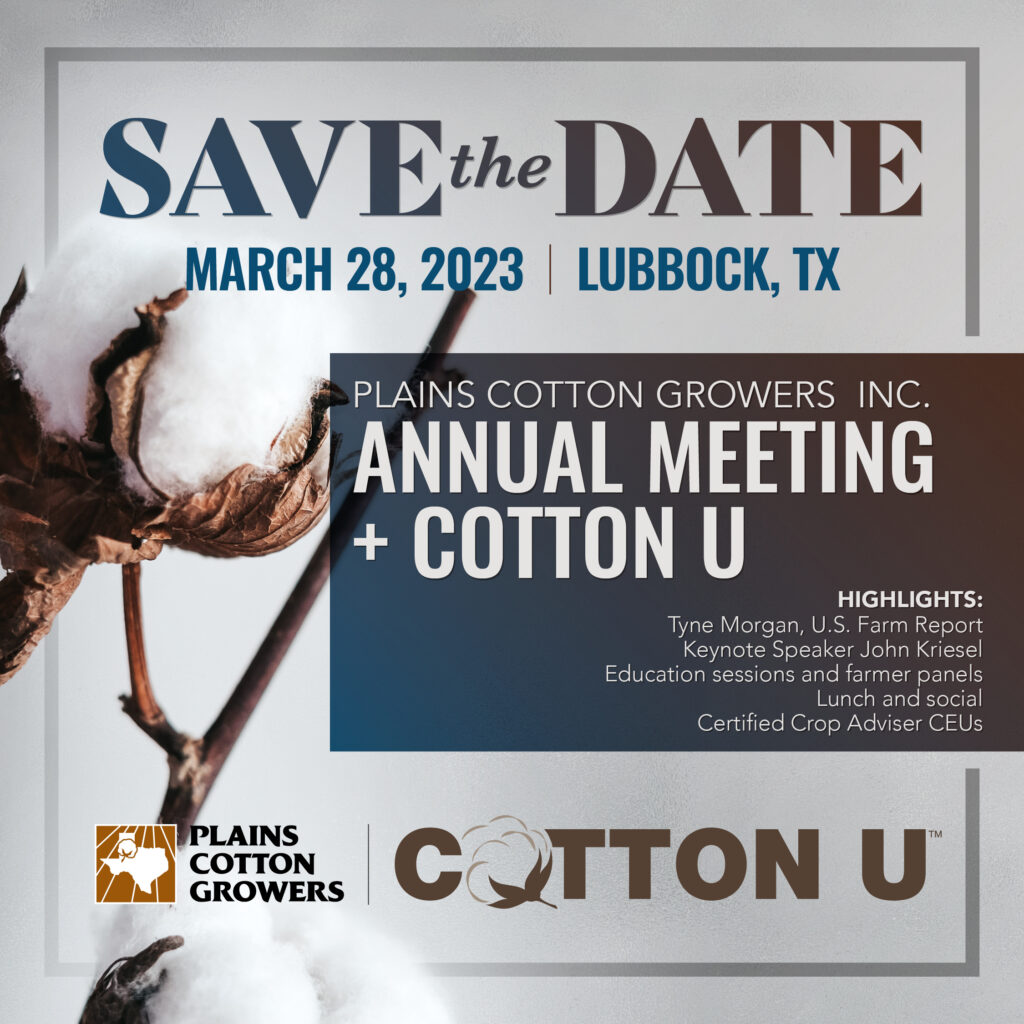

PCG Annual Meeting

PCG’s 66th annual meeting is on March 28 at the Overton Hotel and Conference Center. Register online today!

Ag Budget Views and Estimates Letter Advances Out of Committee

The House Committee on Agriculture convened a business meeting March 9, 2023, to consider its budget views and estimates letter for the 2024 fiscal year. After the letter was reported favorably out of committee, Chairman Glenn “GT” Thompson (R-Pa.) issued the following statement:

“The Committee’s budget views and estimates letter outlines a clear, bipartisan blueprint to invest in the hardworking men and women of American agriculture — the folks who work 365 days a year to feed and fuel our nation. While additional funds are necessary, there is no piece of legislation that provides a better return on investment than the Farm Bill. In the wake of record inflation, a global pandemic, and geopolitical turmoil, American farmers, ranchers, foresters, producers and consumers are suffering. The best way to support them is to pass an effective, bipartisan and timely Farm Bill, and the letter considered today provides a sensible path forward.”

Letter Highlights

- Return on Investment — “…in return for this modest investment…more than 43 million jobs, $2.3 trillion in wages, $718 billion in tax revenue, $183 billion in exports, and $7.4 trillion in economic activity.”

- Farm Debt — “[in 2021]…U.S. farm sector debt climbed above the previous record set in 1980 and has since continued to climb, underscoring the need for a strong farm bill.”

- Protecting the Farm Safety Net — “…Over the last 20 years, the farm safety net has repeatedly been looked to for deficit reduction…Congress has returned to the cycle of providing unbudgeted ad hoc assistance for both weather and market related disasters, totaling $93.3 billion over six years…more than 70% of federal funding for agriculture…Despite this infusion of assistance, the farm financial picture is beginning to erode due to repeated production losses and skyrocketing inflation.”