Welcome to the February 13, 2023 issue of Cotton News, a service provided by Plains Cotton Growers Inc. for the cotton industry in the Texas High Plains and beyond.

U.S. Cotton Industry Gathers at National Cotton Council Annual Meeting

Click the tabs to maximize and minimize the stories below.

U.S. Cotton Industry Gathers for National Cotton Council Annual Meeting

Plains Cotton Growers (PCG) delegates spent the weekend at the National Cotton Council (NCC) annual meeting February 10-12, reviewing and approving resolutions to help guide the U.S. cotton industry in 2023.

“It’s important to stay involved,” said Quentin Shieldknight, producer in Hansford County. “We must fight for farmers and our industry, especially considering what the USDA is doing with Phase 2 of the Emergency Relief Program for the 2020 and 2021 crop years. Influencing policy and implementation of legislation comes from involvement in organizations like PCG and NCC.”

PCG President Martin Stoerner, producer in Floyd County is excited for NCC’s advocacy efforts with the 2023 Farm Bill.

“I remember Congressman GT Thompson (R-Pa.) telling us last year to be organized in our priorities, to have a plan and to come with one voice,” Stoerner added. “I think we are in a good position to do that with the NCC. All working together through our national organizations to make sure our priorities are met with this year’s farm legislation.”

In today’s newsletter, we recap highlights of the annual meeting.

Texas Cotton Producers Discuss Crop Conditions for Planting Season

The Texas Cotton Producers organization met on February 11 to discuss crop conditions for the 2023 planting season among other business.

Rolling Plains

In the Rolling Plains region, it was reported that producers received enough moisture to establish their wheat and haygrazer cover crops, but there may not be enough subsoil moisture to take them to harvest. However, producers are considering trying to make a wheat crop given the current wheat prices. The region projects to have 10% less planting acres than normal, which is about 700,000 acres.

Rio Grande Valley

The RGV area was one of the bright spots of the 2022 crop season; however, the area is now dry, and producers are looking at growing other crops. It’s estimated the area will plant just half the irrigated acres normally reserved for cotton.

South Texas

Producers are feeling pressure to get the cotton crop up within the next month, since there hasn’t been adequate rain to support planting. “We really need a good planting rain to give us a chance,” said Jon Whatley, producer in San Patricio and Nueces Counties.

In 2022, South Texas planted over 840,000 acres, which is above their normal average. This year, it’s projected they will be back in the 750,000 range or less. “Acreage is easy to predict,” added Jeff Nunley, executive director for the South Texas Cotton and Grain Association. “Bales are not.”

High Plains

According to producers in the High Plains, acreage is going to go down, especially in the Panhandle. “If you have irrigation up there, you’re growing grain,” Shieldknight said. “Fertilizer prices have dropped, so guys are buying it for corn as fast as they can right now — major grain shift north of I-40.”

In the South Plains area there’s projected to be a slight reduction in acres; however, Stacy Smith, producer in Lynn County, said he believes the seed price will bump intended planting acres back up.

International Trade Policy Meeting: 'Focus is All on China'

NCC general counsel John Gilliland took the podium at the International Trade Policy committee meeting on February 11 to provide an update on the economic and geopolitical priorities, which all centered on China.

“The U.S. relationship with China is the central organizing principle of our work and the highest priority — where we sit the next couple of years will depend on them,” Gilliland added.

One of the most notable developments in the U.S.-China relationship is the Uyghur Forced Labor Prevention Act. Signed into law on Dec. 23, 2021, by President Biden, the bill ensures that goods made with forced labor in the Xinjiang Uyghur Autonomous Region of the People’s Republic of China does not enter the U.S. market.

Cotton is considered a high-risk sector, meaning the probability of forced labor in the Xinjiang region is high for the commodity. Therefore, the only way to overcome the law as a company is to prove that the product has not been touched by forced labor in any part of the supply chain of that good. “This legislation provides the administration inner agency task force assigned to it a daunting task in applying this standard to all goods coming from that region,” Gilliland said.

Another component of the U.S.-China relationship is competition. The U.S. is implementing strategy to beat China in areas where they are trying to displace us, such as advanced technology.

“The best way to think about the Biden Administration’s economic policy course is to look at it as a return to something we haven’t seen since the early years of the Cold War, which is industrial policy,” Gilliland added.

Last year, Congress enacted the CHIPS and Science Act — a large bill written with a lot of assistance from the Biden Administration to incentivize investment in U.S. manufacturing and advancing technology, specifically in semiconductor chips. The Biden Administration also issued an executive order last year, prohibiting export of semiconductors to certain Chinese buyers. They’re now working with U.S. allies in Europe to encourage them to place export bans on semiconductors to Chinese buyers as well.

“Again, all of this is in an effort to outcompete China,” Gilliland said. “What we’re seeing right now is concerning because the U.S. and China — the two largest economies in the world —are pulling apart or rethinking this notion of globalized economy that is built around a common set of rules.”

To respond to the threat China poses to the U.S., the Administration is focusing on U.S. investment in China and constraining China’s ability to build its own industries: cut off its sources of inputs, cut off its sources of innovation, research and development through U.S. universities and universities with U.S. allies.

“However, outside these sectors, trade with China is actually quite robust,” Gilliland added. “It surprised me when I checked the numbers that we had record-setting exports to China last year. We also had rising imports with everything rebounding from the COVID-19 pandemic.”

Going forward we should expect a growing focus on China from the Biden Administration but also from Congress. “It might be on the one area where we see both parties agree,” Gilliland added.

What does this mean for agriculture?

It’s hard to say in cotton and textiles, but we’re situated differently than the rest of the ag market. For now, China remains an important export market for us, and we expect that to remain because China needs our commodities. However, China is also starting to do some things to diversify their own suppliers around the U.S., according to Gilliland.

The Chinese government is under tremendous stress. Their COVID-19 response drastically altered their economy — their economic growth is far below where they would like it to be. There’s been a lot of news coverage on how their population is now declining for the first time. They’re stressed, and if you’ve read the news lately, you know the U.S. shot down aerial objects said to belong to them. “And if you thought tensions were high when Nancy Pelosi visited Taiwan, just wait until Kevin McCarthy visits. China will not take this lightly. So, we feel these tensions, not only in our national security, but we will probably see them in our trade segments,” Gilliland said.

What about the World Trade Organization?

While the World Trade Organization (WTO) did meet this past June, they weren’t able to make much progress in agriculture. Follow up discussions focusing specifically on cotton didn’t make any headway, either. Most of the work on that front was focused on fertilizer costs and trade facilitation between developing countries. The next meeting is not until 2024, so this year should be relatively quiet from WTO. The WTO’s main focus is institutional reform in settling disputes. The U.S. has been blocking the appointments of new jurists to the appellate body — the WTO’s “supreme court,” so-to-speak. Currently, disputes that are launched with the WTO get a lower court ruling from the dispute panel, but it’s not binding until it’s ruled on by the appellate body or accepted by the entire WTO membership by consensus. “And that really hasn’t been happening,” Gilliland said.

“Until the appellate body is reconstituted, we don’t expect disputes or challenges against U.S. agriculture to go anywhere.”

General Session: New Officers and 2023 Planting Intentions

The NCC general session occurs on the last day of the annual meeting and provides NCC updates and appointment of new officers, as well as an economic outlook with projected U.S. planting projections provided by Jody Campiche, Ph.D., vice president of Economics and Policy Analysis.

projections provided by Jody Campiche, Ph.D., vice president of Economics and Policy Analysis.

Economic Outlook

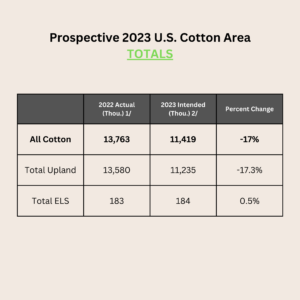

According to the NCC’s 42nd annual Early Season Planting Intensions Survey, U.S. cotton producers intend to plant 11.4 million cotton acres this spring, down 17% from 2022.

Upland cotton planting intentions are 11.2 million acres, down 17.3% from 2022, while extra-long staple (ELS) planting intentions are estimated at 184,000 acres, representing a 0.5% increase.

“Planted acreage is just one of the factors that will determine supplies of cotton and cottonseed,” Campiche said. “Ultimately, weather and agronomic conditions are among the factors that play a significant role in determining crop size.”

Using five-year average abandonment rates along with a few state-level adjustments to account for current dry conditions, Cotton Belt harvested area totals 8.8 million acres for 2023 with a U.S. abandonment rate of 22.6%. Campiche added that these estimates could change based on weather conditions throughout the crop year.

Using the five-year average state-level yield per harvested acre generates a cotton crop of 15.7 million bales, with 15.2 million upland bales and 466,000 ELS bales.

466,000 ELS bales.

“History has shown that U.S. farmers respond to relative prices when making planting decisions,” Campiche added. “Relative to the average futures prices during the first quarter of 2022, cotton prices are lower while the prices of most competing commodities are relatively unchanged. Price ratios of cotton to corn and soybeans are at the lowest level since planting the 2009 crop. In addition, production costs remain elevated.”

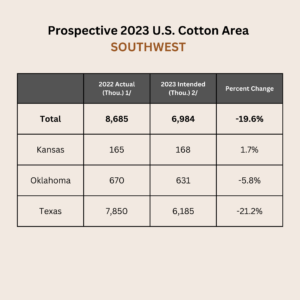

Growers in the Southwest intend to plant 19.6% less cotton. Kansas growers expect to plant 1.7% more cotton, while Oklahoma producers expect to reduce cotton acreage by 5.8%. Texas acreage is expected to decline by 21.2%. Southwest respondents indicated an increase in corn, sorghum and wheat crops for 2023.

NCC delegates were reminded the expectations are a snapshot of intentions based on market conditions at survey time with actual plantings influenced by changing market conditions and weather. Producers will continue to monitor changes in commodity prices and input costs before finalizing their 2023 acreage decisions. Many producers will continue to face difficult economic conditions in 2023 with lower cotton prices and higher production costs.

Shawn Holladay Appointed Chair of National Cotton Council

Shawn Holladay, producer in Dawson and Martin Counties, will serve as the NCC chair for 2023. He is the first High Plains producer to take the helm of NCC since Eddie Smith in 2010. He will work with the council and government officials to influence policy and legislation favorably for the U.S. cotton industry.

work with the council and government officials to influence policy and legislation favorably for the U.S. cotton industry.

“I am honored to continue my representation of the cotton industry in this new role,” Holladay said. “I would like to encourage all associated in this great industry to answer the call to lead. If we are not willing to represent our industry and support our organization, then who will? Our success rests with our willingness to be part of the process.

“I am honored to continue my representation of the cotton industry in this new role,” Holladay said. “I would like to encourage all associated in this great industry to answer the call to lead. If we are not willing to represent our industry and support our organization, then who will? Our success rests with our willingness to be part of the process.

“Everyone is busy, but it’s imperative that part of our daily life be an involvement in the collective support of our industry. If we sit on the sidelines, we cannot be part of the solution. My family and farming operation has benefitted from the education and fellowship associated with participating in our local, regional, and national organizations. We have witnessed firsthand the absolute necessity of having a seat at the table.

“I hope to do my part in consensus building and maintaining cohesiveness with our industry. An industry with a track record of weathering the storm by working together.”

2023 NCC Chair Shawn Holladay presents outgoing chair Ted Schneider with a gift for his service in 2022.

As the outgoing chair of NCC Ted Schneider of Louisiana made his closing remarks, he summed up the entire reason advocacy organizations like NCC are so important.

“I was told a long time ago that the world is ruled by those who show up. And the NCC shows up to fight for agriculture.”