In The Field: Musings From Mark

Field Activity:

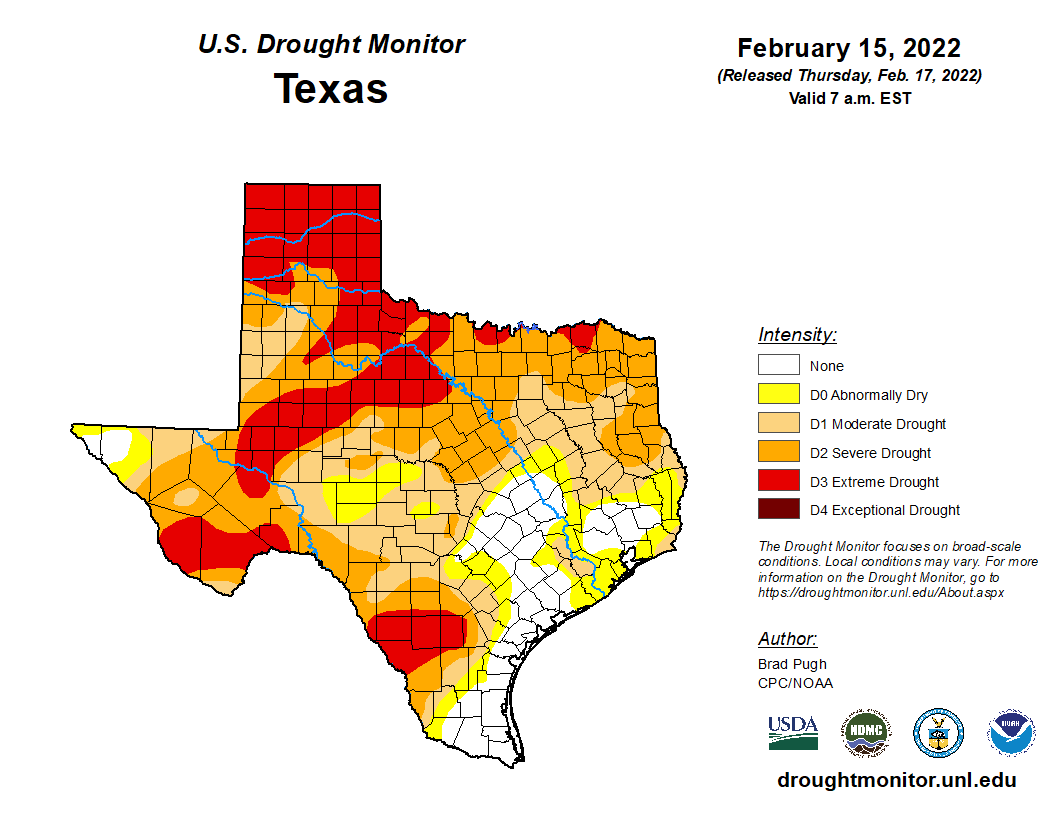

Field activity is still limited because it is so dry. Producers in areas that are more prone to wind erosion are concerned that disturbing the topsoil will cause the fields to blow without any way to stop it.

However, there have been some tractors moving. Some producers are out cutting stalks, applying herbicide and shaping up beds.

Depending on the location and irrigation capability, some producers have cranked wells for pre-plant irrigation. This is more common in areas of stronger groundwater.

Irrigation of wheat under the center pivots has been common. With prices at $10 per bushel — some of the highest wheat prices I have ever seen — I suspect producers are going to try to take some wheat to harvest if they can.

Planting:

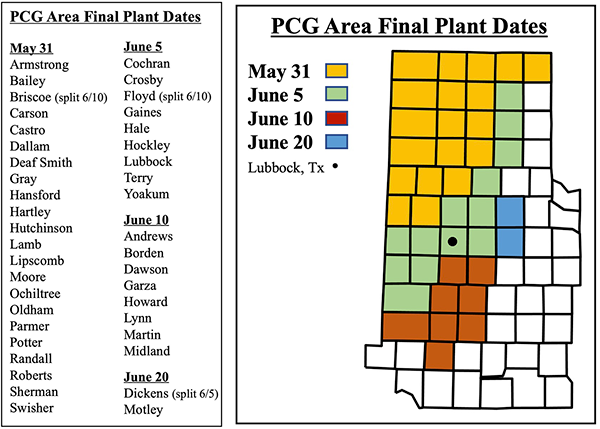

Producers in the Panhandle have an earlier planting date, so they’ll be working on it sooner than the rest of us. They must have their crop planted by May 31 for crop insurance purposes.

Currently, soil temperatures are in the mid-50s to mid-60s right now. Unfortunately, soil temperatures near the surface fluctuate more in dry soil.

The average last freeze date in the Lubbock area is April 9th — for the Amarillo area the date is April 13th.

Mark Brown is director of Field Services

for Plains Cotton Growers Inc.

Pivots and wheat photos were taken in Swisher County.

Cut cotton stalks photos were taken in Hockley County.

Photos were taken in Cochran County.

CRP Acres Down

During a call with reporters from Mexico on Tuesday, U.S. Department of Agriculture Secretary Tom Vilsack provided more details regarding the general Conservation Reserve Program sign-up that ended March 11th. He said only 1.8 million of the 4 million acres in expiring contracts will be re-enrolled in the program as 52% to 56% of the maturing acres were not offered in the general sign-up. He also said that new contracts on around 800,000 acres would be offered. That would be a net loss of 1.4 million CRP acres.

Agriculture Secretary Tom Vilsack provided more details regarding the general Conservation Reserve Program sign-up that ended March 11th. He said only 1.8 million of the 4 million acres in expiring contracts will be re-enrolled in the program as 52% to 56% of the maturing acres were not offered in the general sign-up. He also said that new contracts on around 800,000 acres would be offered. That would be a net loss of 1.4 million CRP acres.

USDA Announces First Round of Disaster Assistance

The United States Department of Agriculture Farm Service Agency (FSA) has announced the first round of disaster assistance authorized by the Extending Government Funding and Delivering Emergency Assistance Act. In late September, Congress authorized up to $10 billion in aid to crop and livestock producers impacted by adverse weather conditions that occurred during the 2020 and 2021 calendar years.

Details about disaster assistance and its deliverables to producers have been sparse, however, publication of the Federal Register notice announcing Phase 1 of the Emergency Livestock Relief Program (ELRP) on April 4, 2022, has provided good insight into how FSA is handling key aspects of the ELRP. The notice explains how FSA will apply pay limits, determine payment eligibility and what we anticipate as other common components of disaster assistance to row crop producers in the coming months.

The ELRP will utilize up to $750 million of the $10 billion set aside by Congress to provide payments to livestock producers who incurred increased supplemental feed costs as a result of forage losses caused by drought or wildfire in calendar year 2021. The program will utilize existing data submitted through the FSA Livestock Forage Disaster Program (LFP) to calculate ELRP payments to eligible producers.

Payment Calculation

FSA has set the ELRP Phase 1 payment rate at $16.84 per animal unit for historically underserved farmers and ranchers and $14.03 per animal unit for all other producers. To stay within available funding, the payment rates were set at 90% of the gross 2021 LFP payment rate ($18.71) for historically underserved farmers and ranchers and 75% of that rate for all other producers.

For example, consider a historically underserved farmer or rancher who has 535 animal units. Based on the 2021 LFP payment rate of $18.71 multiplied by the total animal units, the producer’s estimated gross 2021 LFP payment would be $10,000. The ELRP payment percentage for a historically underserved farmer or rancher is set at 90% of the gross LFP, therefore the ELRP Phase 1 payment in this example is $9,000

By comparison, a non-historically underserved farmer or rancher that also has 535 animal units would have the same $10,000 estimated gross 2021 LFP payment amount — based on the 2021 LFP payment rate of $18.71 multiplied by the total animal units. The ELRP payment percentage for a non-historically underserved farmer or rancher is set at 75% of the gross LFP rate and therefore provides an ELRP Phase 1 payment of $7,500.

Program participants are subject to all eligibility requirements and payment limitations. For more detailed information on the program and additional information as it becomes available, please visit: https://www.fsa.usda.gov/programs-and-services/emergency-relief/index

Producer Relief Fund

The Southwest Council of Agribusiness (SWCA) established the SWCA Producer Relief Fund as an effort to help those affected by the wildfires in the Eastland area of Texas. Click here to contribute through the website.

Alternately you may mail a check, made out to the SWCA Producer Relief Fund, to the following address:

SWCA Producer Relief Fund

ATTN: Dava Denson

8303 Aberdeen Avenue

Lubbock, TX 79424

For questions regarding the SWCA Producer Relief Fund, please reach out to Jimmy Clark or call 806-790-6011.

“What we need most are rain and prayers,” said Debora Gordon with the Eastland Community Foundation — the entity that will distribute the producer relief funds. “It’s wonderful to see people helping people.”

development and implementation of the 2018 Farm Bill along with various “ad hoc” programs that have been critical to keeping cotton producers in business.

development and implementation of the 2018 Farm Bill along with various “ad hoc” programs that have been critical to keeping cotton producers in business.

participate in their soil carbon assessment to determine baseline levels across Texas. The following management practices are desired:

participate in their soil carbon assessment to determine baseline levels across Texas. The following management practices are desired:

out the window of my grandparent’s house watching my mother run around in the rain directing the truck on where to park our trailer house. “The Farm,” as we called it, houses magical memories from my childhood. I know I’m not the only one.

out the window of my grandparent’s house watching my mother run around in the rain directing the truck on where to park our trailer house. “The Farm,” as we called it, houses magical memories from my childhood. I know I’m not the only one. the economy. Now, two years after the initial COVID-19 outbreak, the Fed is raising the rates to compete with increasing inflation — which is the highest its been since 1982. With hopes of curbing inflation, the Fed is increasing the benchmark interest rate to 0.25%. It’s likely they won’t stop there as experts estimate there could be as many as six more interest increases this year.

the economy. Now, two years after the initial COVID-19 outbreak, the Fed is raising the rates to compete with increasing inflation — which is the highest its been since 1982. With hopes of curbing inflation, the Fed is increasing the benchmark interest rate to 0.25%. It’s likely they won’t stop there as experts estimate there could be as many as six more interest increases this year.

prices would go up. Some analysts are upping the odds of a $5-plus regular gasoline average on the horizon. While oil came back down after surging to nearly $140 a barrel early Monday, investors are betting it’s going to spike again soon, said Jim Wisemeyer with ProFarmer. “Currently, the price for a gallon of regular gasoline soared to a new record high of $4.14, breaking the previous record of $4.11 set in 2008,” Wisemeyer added.

prices would go up. Some analysts are upping the odds of a $5-plus regular gasoline average on the horizon. While oil came back down after surging to nearly $140 a barrel early Monday, investors are betting it’s going to spike again soon, said Jim Wisemeyer with ProFarmer. “Currently, the price for a gallon of regular gasoline soared to a new record high of $4.14, breaking the previous record of $4.11 set in 2008,” Wisemeyer added.

Justice (DOJ) and the Federal Maritime Commission (FMC) and that the White House will “make sure large ocean freight companies cannot take advantage of U.S. businesses and consumers.”

Justice (DOJ) and the Federal Maritime Commission (FMC) and that the White House will “make sure large ocean freight companies cannot take advantage of U.S. businesses and consumers.”

purchase a Stacked Income Protection Plan (STAX) insurance policy for the 2022 crop year.

purchase a Stacked Income Protection Plan (STAX) insurance policy for the 2022 crop year.