PCCP Participation Skyrockets Cover Crop Acres

The U.S. Department of Agriculture (USDA) Risk Management Agency has now concluded sign-up for the 2022 Pandemic Cover Crop Program (PCCP). The program provides premium support to producers utilizing cover crops in their production systems. Since its original enactment in 2021, PCCP has vastly increased the number of cover crops now being grown and/or reported to the USDA Farm Service Agency (FSA).

Prior to PCCP’s development, U.S. farmers on average reported 2 to 3 million acres of cover crops annually. In 2021, over 14 million acres of cover crops were reported to the USDA FSA.

In 2021, the PCCP program provided $59.5 million in support to eligible farmers across the U.S., of which Texas presumably received $6.2 million — the Plains Cotton Growers region received $5.1 million of the total amount.

While it is recognized that not every region in the U.S. can produce a cover crop based on various agronomic conditions, weather patterns and other factors, PCCP has certainly proven to be a successful program for farmers that have an interest in cover crop systems. -Kody Bessent

Your Story Matters

We moved to Dickens County when I was five years old. I still remember looking out the window of my grandparent’s house watching my mother run around in the rain directing the truck on where to park our trailer house. “The Farm,” as we called it, houses magical memories from my childhood. I know I’m not the only one.

out the window of my grandparent’s house watching my mother run around in the rain directing the truck on where to park our trailer house. “The Farm,” as we called it, houses magical memories from my childhood. I know I’m not the only one.

I’m not the only one who learned to drive way before I should have. Who woke up early to feed animals before school and stayed up late to do the same. Who rode in the tractor as my dad plowed until dark. My story is important to me, but your story is important to the world.

You are the face of agriculture. The ones responsible for the clothes we wear. We need you. And most people don’t realize just how much.

I’m starting a new series of stories titled, “Faces of Cotton.” To participate, visit:

plainscotton.org/story-submission.

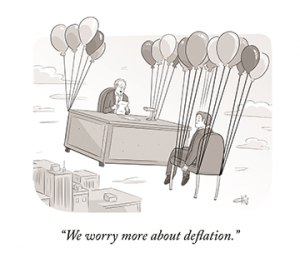

Rising Rates

The Federal Reserve slashed interest rates during the pandemic in an effort to boost the economy. Now, two years after the initial COVID-19 outbreak, the Fed is raising the rates to compete with increasing inflation — which is the highest its been since 1982. With hopes of curbing inflation, the Fed is increasing the benchmark interest rate to 0.25%. It’s likely they won’t stop there as experts estimate there could be as many as six more interest increases this year.

the economy. Now, two years after the initial COVID-19 outbreak, the Fed is raising the rates to compete with increasing inflation — which is the highest its been since 1982. With hopes of curbing inflation, the Fed is increasing the benchmark interest rate to 0.25%. It’s likely they won’t stop there as experts estimate there could be as many as six more interest increases this year.

Prices Continue to Seesaw Adding to Growers’ Frustration

Price is always an important part of the equation. A good year production-wise can be offset by low price. And, also higher than expected costs.

A high price is needed for 2022 production. Pricing low can be costly financially. But in markets, we don’t know what’s low and what’s high until after the fact. Case in point, some growers priced a portion of expected 2021 production at 85 to 95 cents and felt good about it — but then watched price go to $1.20.

Growers are reluctant to jump in too early this year for fear of making that mistake again. They know price is going to be especially important because any profit margin is going to be slim.

New crop December futures has thus far made a run to $1.06 before retreating back to the $1.00 area. December presently stands about $1.02. Some producers have already priced a portion of expected 2022 production. I sense those who have not are waiting on another run and if already priced, uncomfortable doing more.

University of Georgia Extension estimates are used to compare costs this season to last season. The estimates show the increases for seed, fertilizers and lime, chemicals, and fuel. Assuming a generous 2-bale (1,000 pounds) average yield, these cost increases alone add an extra 17.7 cents per pound to the price needed for cotton.

Events of the Russia-Ukraine situation seem to often override other factors in the market. It is not at all clear, however, if these events are positive or negative for cotton and for what reason. Using February 23rd (before the Russia invasion began) as the baseline, corn and wheat have increased. Cotton and soybeans have not.

USDA’s March supply/demand numbers last week were mostly bullish. This market continues to ride on the expectation of strong demand continuing for the 2022 crop and underlying uncertainty in U.S. production due to continued dry conditions.

Don Shurley, University of Georgia Economist

(Story originally published on AgFax.)