Legislation to Reduce Farm Input Costs Introduced

On Wednesday, Rep. Glenn “GT” Thompson (R-Pa.), House Agriculture Committee Ranking Member, introduced a new act that would require the Biden Administration to reverse its regulatory barriers to domestic agriculture production and provide immediate relief to families across the country.

Thompson was joined by more than 20 original cosponsors, including Republican Leader of the Natural Resources Committee, Bruce Westerman, and Chairman of the Western Caucus, Dan Newhouse, in support of H.R. 8069 “Reducing Farm Input Costs and Barriers to Domestic Production Act.”

“The U.S. and world face a disrupted global food system resulting in increased energy prices, fertilizer cost spikes and product shortages, and worsening food scarcities in developing countries,” Thompson said in Wednesday’s press conference. “We’re in a crisis moment and need concrete, immediate policy actions to help mitigate impacts both at home and abroad. American agriculture, if given the right tools and regulatory confidence, can serve a vital role in alleviating global food instability and mitigating costs for consumers.”

Specifically, the bill:

- Provides relief from EPA’s unprecedented actions related to crop protection tools

- Offers clarity related to WOTUS regulations

- Rescinds the SEC’s harmful proposed rule on climate-related disclosures

- Reinstates the 2020 NEPA streamlining

- Requires an economic analysis on the costs and benefits of GIPSA rules

According to DTN Ag Policy Editor Chris Clayton, Thompson and others highlighted skyrocketing inflation, pointing to farmers paying 115% more for diesel fuel than a year and fertilizer prices more than double what they were a year ago. While Russia’s invasion of Ukraine has exacerbated energy, food and fertilizer inflation, Thompson and other Republicans said the inflationary challenges were already on their way before the war began.

“In fact, since the war in Ukraine began, the administration has continued to take nonsensical regulatory and policy actions that have created needless uncertainty for American farmers, ranchers and working families that have further limited our ability to meet the food demand of our nation and, quite frankly, the world,” Thompson said.

H.R. 8069 is written in response to the House voting on H.R. 7606 “Lower Food and Fuel Costs Act,” which House Democrats maintain would help with food, energy and fertilizer costs. H.R. 7606 would ensure E15 continues year-round, but would also install a special investigator at the U.S. Department of Agriculture to investigate competition issues in the meatpacking industry, which many House Republicans staunchly oppose. However, H.R. 7606 did pass in the House yesterday by a vote of 221 to 204, though Congressman Thompson argued it, “does nothing to lower food and fuel costs.”

Ocean Shipping Reform Act Signed Into Law

The highly anticipated Ocean Shipping Reform Act was passed by the House on Monday, June 13th, and signed into law by President Biden on Thursday, June 16th.

The bill increases industry transparency while giving the Federal Maritime Commission (FMC) more authority as it oversees U.S. shipping and logistics.

According to lawmakers, the bill gives the FMC the tools it needs to cut down on extraneous shipping costs while also prohibiting shipping carriers from leaving American agricultural exports behind.

As retailer container ports are expected to reach near-record volume in June, Congress is hopeful that the bill will help alleviate some of the burden put on major retail companies as they strive to meet consumer demand and protect themselves from disruptions in West Coast ports.

OSRA prevents unjustified and illegal fees collected from American truckers by ocean shipping companies, as well, according to American Trucking Associations President Chris Spear.

The bill passed unanimously in the Senate in March.

When Looking at Markets, Brace with Faith

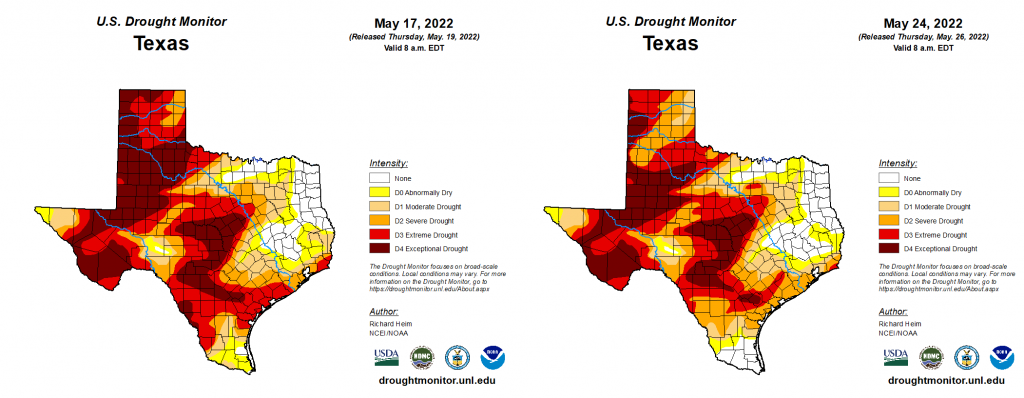

With federal spending at an all-time high, and inflation reaching 8.5% — the highest rate since 1982 — it’s safe to say that consumers are struggling. But more importantly, the world economy is struggling.

As of May 2022, gasoline has increased by 48.7% over a 12-month period, with energy coming in second at 34.6%. Food prices have gone up 10.1%, according to the consumer price index, leading House Republicans to write a letter urging President Biden to address the high costs to consumers and farm families alike.

While there is $2 trillion sitting in U.S. household savings accounts, Keith Lucas, vice president of Marketing for Plains Cotton Cooperative Association (PCCA), said this reserve is projected to run out in six to nine months at current inflation rates. “We’re now below pre-pandemic levels as far as savings is concerned,” he added. “People aren’t putting money away mainly because they don’t have it. They’re using everything they have on increased housing, food and fuel costs.”

At the PCCA Delegate Body Meeting Wednesday, Lucas went on to say, “If the U.S. economy is 16% of the world’s economy and the U.S. consumer is 70% of the U.S. economy, the U.S. consumer must represent 11.2% of the world economy. And U.S. consumers are tightening up their money belts.”

According to JPMorgan CEO Jamie Dimon, a storm is coming when pandemic stimulus money runs out, saying, “You better brace yourself.”

The marketing report at the PCCA meeting was sobering, but resiliency in its finest came when Kevin Brinkley, PCCA President, made the following statement.

“I learned the Farmers Cooperative Association in Tahoka, Texas, is 92 years old while at their annual meeting,” Brinkley said. “When Bryan Reynolds, gin manager, made his statements, I understood why. He said, ‘God is still God. And He’s going to get us through this.’ And I thought that’s how a co-op makes it 92 years — on faith.”

Pest Management Outlook

Suhas Vyavhare, Ph.D., assistant professor and extension entomologist, and Kerry Siders, M.S., extension agent integrated pest management for Hockley and Cochran Counties, provide insight into pest management for the coming season.

Suhas Vyavhare

“Most of our activities so far have revolved around thrips in the northern areas. I’ve heard reports of some guys spraying for thrips twice, which is unusual. I am seeing a decline in the population, and I also think with highs in the mid-90s, clients are in a better position to recover from thrips moving forward.

“I am now working toward shifting my focus to cotton flea hoppers and plant bugs as we start seeing squares on the plant.”

Kerry Siders

Kerry Siders

“The recent rains have brought on a flush of weeds, which temporarily will serve as the primary host for all sorts of species whether its plant bugs, larva pests, etc. The weeds are not going to last very long in hot, dry, windy conditions, so unfortunately what islands of green we have irrigated whether it’s cotton, grain sorghum or corn, it’s going to be a magnet for these pests. This is not a certainty, just a warning for everyone to watch for. Pat Porter’s (Texas A&M University professor and extension entomologist) army worm traps have been all over the board, but there are some days where it’s off the charts, which doesn’t bode well.

“We built a high population last year because of the weed species, which wasn’t necessarily reflected in the crop but it was in the weeds. We most likely carried a high number of the population over because of the mild winter. I hate to be the bearer of bad news, but these are just things we need to be aware of.

“Also, I wanted to note that we’ve had several producers spraying weeds primarily with dicamba. If your crop gets hailed out or fails in some way, you’re going to want to get it adjusted as quick as you can and probably dry plant some milo or something. If you get a rain or irrigate that up, give yourself at least a two-week window between application of that dicamba and grain sorghum or you’ll risk injury to your new crop.”

Cotton Industry Seeks Volunteers

The success of the High Plains cotton industry, like any group effort, is directly tied to the willingness of qualified individuals to volunteer to serve in various leadership positions.

PCG encourages all qualified individuals in the High Plains interested in serving as a representative to the Cotton Board, National Cotton Council or Cotton Incorporated, to contact the PCG office at 806-792-4904 for more information.

The success of the High Plains cotton industry, like any group effort, is directly tied to the willingness of qualified individuals to volunteer to serve in various leadership positions.

The success of the High Plains cotton industry, like any group effort, is directly tied to the willingness of qualified individuals to volunteer to serve in various leadership positions.

challenges faced by the classing offices in 2021, which caused significant delay in the grade turnaround to gins and producers. Similar issues are expected in 2022 due to significant labor shortages, increasing wage rates, COVID-19 protocols and supply chain issues. The NCC has requested $4 million in fiscal year 2023 appropriation that would assist in increasing automation at the classing offices to assist with long-term labor challenges. Earnest also announced a $0.20 (from $2.30 to $2.50) increase in the cotton classing fee.

challenges faced by the classing offices in 2021, which caused significant delay in the grade turnaround to gins and producers. Similar issues are expected in 2022 due to significant labor shortages, increasing wage rates, COVID-19 protocols and supply chain issues. The NCC has requested $4 million in fiscal year 2023 appropriation that would assist in increasing automation at the classing offices to assist with long-term labor challenges. Earnest also announced a $0.20 (from $2.30 to $2.50) increase in the cotton classing fee.

Plains Cotton Growers Inc. joins organizations across the stae to highlight theimportance of land stewardship during Texas Soil Stewardship Week April 24th through May 1st.

Plains Cotton Growers Inc. joins organizations across the stae to highlight theimportance of land stewardship during Texas Soil Stewardship Week April 24th through May 1st. denim (made from cotton) so it can be recycled back to its original fiber state and transformed into something new.

denim (made from cotton) so it can be recycled back to its original fiber state and transformed into something new.

where he attended the local high school, and later, Texas Tech University. While at Texas Tech, Adkins worked at the Texas A&M Agricultural Research and Experiment Station where he gained a deeper knowledge of agriculture. Upon his graduation, Adkins took a position with the FSA. Kelly has enjoyed a long career serving the farmers and ranchers of Texas. He has held a variety of positions during his tenure at FSA including County Executive Director in Grimes and Randall Counties, District Director, TASCOE Director, Mediation Coordinator, and as a County Office Trainee Program Trainer and Instructor. Kelly currently lives in Canyon, TX and spends his time helping run a small farming/cattle operation in Randall County.

where he attended the local high school, and later, Texas Tech University. While at Texas Tech, Adkins worked at the Texas A&M Agricultural Research and Experiment Station where he gained a deeper knowledge of agriculture. Upon his graduation, Adkins took a position with the FSA. Kelly has enjoyed a long career serving the farmers and ranchers of Texas. He has held a variety of positions during his tenure at FSA including County Executive Director in Grimes and Randall Counties, District Director, TASCOE Director, Mediation Coordinator, and as a County Office Trainee Program Trainer and Instructor. Kelly currently lives in Canyon, TX and spends his time helping run a small farming/cattle operation in Randall County.

show the surging fertilizer price impact on U.S. farmers is over double the drag estimated in a report late last year. Lawmakers may use the information to decide whether to push a program that would temper some of the price implications.

show the surging fertilizer price impact on U.S. farmers is over double the drag estimated in a report late last year. Lawmakers may use the information to decide whether to push a program that would temper some of the price implications.