Welcome to the January 5, 2024 issue of Cotton News, a service provided by Plains Cotton Growers Inc. for the cotton industry in the Texas High Plains and beyond.

Government Shutdown Attempt No. 3? (and other news)

In case you missed it, here’s the latest news roundup that could impact producers on the Texas High Plains.

Border Security Challenges Government Operations

By Kara Bishop

We’re experiencing yet another sense of deja vu as the risk of a government shutdown increases amid Congress butting heads on funding measures, specifically border security, funding for Ukraine, etc.

The government shutdown deadline for Agriculture among others is January 19, causing House Republicans to seek ways to attach border security reforms to whatever government funding legislation they come up with to keep the doors open. The Senate has also been working on developing some border security measures, but House Republicans feel it’s a lame attempt to bolster President Biden’s approval rating ahead of the election.

“I can’t see where the House would automatically accept a Senate version when we’ve passed our own bill, H.R.2.,” said Rep. Tony Gonzales (R-Texas) to CNN, whose district encompasses the border.

H.R.2, “Secure the Border Act of 2023,” was passed by the House of Representatives on May 11, 2023, with a vote of 219-213.

Senate Democrats strongly oppose some measures of this legislation, while some House Republicans say they will block any legislation that doesn’t include drastic restrictions of the asylum process while simultaneously establishing a new surveillance system that cracks down on the existing illegal immigrant population.

And there’s no doubt about it — what’s happening at the border is a problem.

According to CNN who received preliminary statistics from Homeland Security, border authorities encountered more than 225,000 migrants along the US-Mexico border December 2023, marking the highest monthly total recorded since 2000. Over the course of the month, authorities dealt with more than 10,000 migrants crossing daily.

“While we believe there should be solutions offered to secure our border, we’re also sensitive to the fact that migrant labor is crucial to agriculture and the workforce needed to continuously provide a reliable food and fiber source for the U.S.,” said PCG CEO Kody Bessent.

Suffice it to say, the battle lines are drawn, and it will be a fight to the end during these next two weeks, and hopefully for agriculture, we will avert another shutdown.

“It’s never good for the cotton industry when the government shuts down,” said PCG CEO Kody Bessent. “But right now at the close of our crop year, producers are selling cotton and the operations of the U.S. Department of Agriculture’s Commodity Credit Corporation (USDA CCC) are crucial for producers and merchants alike. If the CCC shuts down January 19, there’s nothing to stand in the financial gap that exists between producers and merchants when selling product. With the current adverse risk the cotton industry is going through, the last thing we need is extra risk from a shutdown.”

The shutdown would also halt any disaster assistance or PARP funding for producers, which can make or break a producer’s bottom line, and enrollment for programs through the Farm Service Agency would cease until the government reopens.

Is El Nino to Blame for the Historic Heat and Drought that Gripped the U.S. in 2023?

2023 was a year full of weather impacts on crops and livestock. From the intense heat in the South to the drought that parked itself across the South and Midwest, USDA meteorologist Brad Rippey says those are the two weather events that stole headlines this past year.

“When we look back at 2023, I’m actually going to break heat and drought into two separate categories,” says Rippey. “Really, when you look at the extreme heat this past year, it was focused across the deep South from Arizona to Florida, and pretty much everywhere in between. And that was certainly a huge weather story that affected parts of the cotton belt.”

From wiping out a large part of the cotton crop in west Texas to hitting sugar cane production in Louisiana, Rippey says nearly the entire deep South saw impacts of the year’s extreme heat.

“Of course, that came with drought in many cases. But when you look at these overall temperatures, the hottest summer on record and a lot of hottest months on record, that was a big story in the deep South,” says Rippey.

While other parts of the U.S. still had drought, in some areas it didn’t pack as big of a punch because it came without the heat. That was the case in much of the Corn Belt. The drought hit last year without the extended intense heat, which had a big impact on crops.

“We were very fortunate, especially in the Corn Belt, that we did not see the combination of extreme heat and drought at the same time. And that actually led to some of those better outcomes than expected for U.S. corn,” explains Rippey.

With USDA currently projecting the 2023 U.S. corn crop to be the largest on record, Rippey says the mild temperatures are what helped save the crops.

“You do see that things actually turned out better in states like Iowa. When you look at the rainfall numbers, they were abysmal, almost as dry as 2012. But then the heat just wasn’t there. And today’s varieties are little bit more tolerant of drought and heat. And the outcome was a little better than we expected,” says Rippey.

It wasn’t all good news. While crop yields turned out better than expected for some farmers, the lack of moisture continued to dwindle grazing conditions and hay stocks in 2023. Those created additional hurdles in rebuilding the shrinking U.S. cattle herd.

So, what was the culprit that caused the intense heat that suffocated the South during the summer months? Rippey says while it’s still being studied, he thinks it’s tied to one major weather event in 2023, in particular.

“I will go out on a limb and say that that may have been an early sneak attack from El Niño,” says Rippey. “The reason I say that is that because we did have an early onset El Niño. It was pretty much in place by late spring, early summer. It’s pretty consistent with El Niño to have a big ridge of high pressure that comes out of Central America. And at times, we’ve seen it before, that does sometimes extend all the way into the southern tier of the United States.”

He says El Niño can also be tied to the shipping crisis that wreaked havoc on exports in 2023, causing massive shipping delays, as well as forcing shippers to carry lighter loads.

“And certainly what happened in Mexico and parts of Central America, think about the Central American drought that’s causing shipping problems in the Panama Canal. A lot of that, I think, could be tied to the heat in the atmosphere related to the early onset El Niño,” says Rippey.

According to Rippey, the drought in the Midwest can be attributed to the blocking high pressure that wouldn’t budge across Canada this past spring, summer or fall.

“The U.S. Midwest happened to be on the southern end of a lot of that high pressure over Canada. So when we think about that, think about the Canadian wildfires, all the smoke coming down. And we were just on the southern edge of that in the Midwest,” Rippey explains.

He says that, along with Northeasterly winds blocking moisture from the Gulf, is what caused the drought in the Midwest.

“At the same time, high pressure was far enough north that the heat and unusual warmth were actually focused across Canada. So, it wasn’t all that hot on the southern end of the high, but it was dry. And that led to that cool drought in the western Corn Belt,” he adds.

El Niño is still in play, as Rippey says El Niño made a splash once again to close out 2023.

“Now that El Niño has kicked in, it’s a strong event, it could be one of the strongest on record,” says Rippey. “We’re seeing that influence of El Niño starting to grab a hold of the reins of U.S. weather patterns. And that’s pretty normal and certainly should continue into early 2024.”

What’s on tap for 2024? Rippey forecasts the intense El Niño will lead to what he calls “pretty profound” impacts for the rest of the winter, and even into spring.

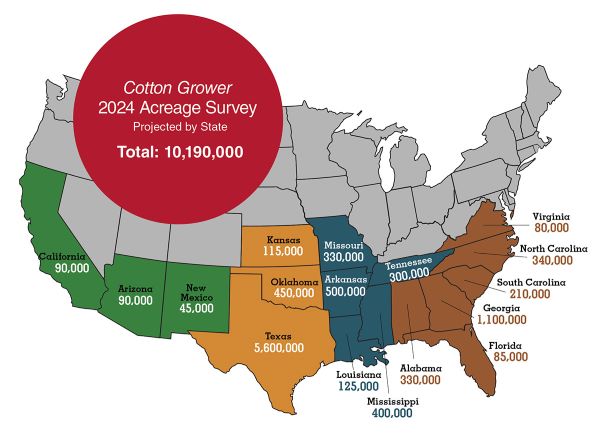

In Tough Times, Cotton Acres Holding Steady for 2024

Here we go again. Stepping out into the unknown. Sticking our necks out to kickstart the new year’s cotton acreage projection game once more.

Photo credit: Cotton Grower Magazine

In reality, Cotton Grower’s track record for acreage projection has been pretty good for the past several years. And, if nothing else, it gives the industry something to ponder and/or poke fun of until the more esteemed scientific surveys from the National Cotton Council and USDA are released in the coming months.

As always, these acreage projections are based on input and conversations with multiple stakeholders in the cotton industry — our readers, state cotton specialists, economists, and others related to U.S. cotton. It’s a reporting job with math involved, and we try to do our best with the information we get.

That said — and based on the information in hand as of mid-December — U.S. cotton growers are projected to plant a total (upland and Pima) of 10.19 million acres in 2024. That’s a decrease of roughly 42,000 acres from USDA’s 2023 reported plantings last October, or approximately .5% down from 2023’s pre-harvest numbers.

In essence, our calculations show no significant change in cotton acreage from late 2023.

What Happened?

One year ago, U.S. cotton growers were feeling pretty good about their crop prospects for 2023. Prices were still acceptable (but not high), and early season moisture gave hope for a good start to the year across most of the Cotton Belt. Flooding issues washed some traditional cotton acres in California and Texas away to alternative crops, and another summer of searing heat baked away prospects of favorable yields, especially across the Southwest, still reeling from the effects of the historic drought of ’22.

USDA’s final October tally of 10.23 million acres shows how much Mother Nature and other market forces took out of the early 2023 projections of 11.0 to 11.5 million acres.

As expected, there was one overriding comment in nearly every response we received — cotton prices in relation to other commodities will strongly influence cropping decisions and acres for 2024. Of course, continuing inflation concerns, global demand for cotton, political and geopolitical issues, and continued high production costs certainly have an impact, too.

“If you look at the historical corn/cotton ratio, the results point to about 10.8 million acres of cotton,” says Dr. Darren Hudson, Professor and the Larry Combest Endowed Chair for Agricultural Competitiveness and Director of the International Center for Agricultural Competitiveness at Texas Tech University. “The problem is the ratio doesn’t capture our current level with 77-cent cotton and $5 corn. The ratio would suggest it’s more favorable to cotton this year than last year. But my gut tells me that at 77 cents, we’re just not going to get a lot of it.”

Here are the survey results on a regional basis.

Southeast

Overall, sources in Alabama, Florida, Georgia, the Carolinas, and Virginia indicated they’ll plant 2.15 million acres of cotton in 2024, an 8% decrease from 2023. As the number indicates, acreage across the region should hold relatively steady, especially in Georgia, to slightly down. No acreage increases were anticipated in any of the region’s states.

“Multiple factors are depressing cotton,” says Steve Brown, Alabama Extension Cotton Specialist. “The price is not in the upper 80s or better. Severe drought in southwest Alabama and harvest season rainfall were disappointing. And rising input costs remain.”

“In North Carolina, meaningful improvements in price would likely increase our acreage noticeably,” says Guy Collins, North Carolina State Extension Cotton Specialist. “Severe drought in some places in 2023 may affect some acreage decisions.”

“I’m generally an optimist when it comes to acreage, but I’d predict Georgia stays stagnant at best compared to 2023,” says Camp Hand, University of Georgia Extension Cotton Specialist. “We still have more infrastructure in place for cotton compared to corn, and there aren’t many other options to break a dryland peanut rotation other than cotton. We are a cotton state. And in my mind, we will stay that way for the foreseeable future.”

Mid-South

Most Mid-South states are projecting flat to slightly decreased acreage for 2024, with the exception of Tennessee where a slight increase is indicated. All totaled, the survey results show 1.65 million acres for 2024 across the five-state region.

“I think acres will be pretty flat,” says Brian Pieralisi, Mississippi State Extension Cotton Specialist. “It’s really hard to say for sure with south Mississippi still in such a drought. I wouldn’t expect a large increase in acres as long as prices stay in the 80-cent range.”

“Looking at futures for cotton, the price appears to be holding flat, and I’m sure most potential growers would be more comfortable with it higher,” notes Trey Price, LSU Extension Cotton Specialist. “All that being said, I don’t expect to see much of an increase in cotton acreage, if any.”

“I expect we will pick up just shy of 50,000 acres to bring us back to the 300,000-acre mark in Tennessee, with a plus or minus of about 75,000,” predicts Tyson Raper, University of Tennessee Extension Cotton Specialist. “The 2023 Tennessee crop was nothing short of incredible, and I suspect the subsequent excitement with the commodity will push our increase. But there’s a long way to go before May!”

Southwest

The lingering effects of the 2022 drought combined with triple-digit summer heat to hamper cotton production across the region. Overall, production results were marginally better than 2022, as some areas did fine while growers in other parts of the region faced another year of insurance claims and abandoned acres.

Based on our survey input, Kansas, Oklahoma, and Texas growers anticipate planting a combined 6,165,000 cotton acres in 2024 — a very slight .8% increase from final planted acres in 2023.

West

Once again, grower decisions on cotton in California, Arizona, and New Mexico continue to hinge primarily on water availability and cotton price. In 2023, final USDA numbers showed 239,000 acres of cotton across the three states. Projections for 2024, based on current input, show approximately 225,000 total cotton acres for 2024 across the region — a nearly 6% decrease.

Snapshot in Time

For the second consecutive year, primarily due to current cotton prices and other uncontrollable market factors, few respondents were fully confident in their projections. Some, in fact, would not be surprised to see 9.8 million acres while others could potentially see up to 10.5 million acres. This is our best guesstimate for now.

The Cotton Grower survey reflects a snapshot of the market situation and prevailing attitudes in late November and early December, as 2023 harvest was still wrapping up in some areas. Many thanks to the growers, ginners, consultants, specialists, and other industry sources for their input.

PCG Announces 2024 Annual Meeting

PCG’s biggest industry event of the year is scheduled for April 2, 2024 at the Overton Hotel & Conference Center in Lubbock, Texas.

We’re excited to bring you some top-notch speakers and special segments including renowned customer experience and younger generation expert David Avrin and the U.S. Farm Report.

Mark your calendars and stay tuned — we will open registration with all the details soon!

PCG 2024 Seed Cost Calculator Released

The 2023 version of the Plains Cotton Growers Inc. Seed Cost Calculator is available for download at any time on the PCG website at the bottom of the “Resources” page.

The PCG seed cost calculator is an interactive Microsoft Excel spreadsheet that allows producers to calculate an estimated cost per acre, for both seed and technology, based on published suggested retail prices.

Questions about the tool can be directed to Shawn Wade.

West Texas Cotton Quality Report for the 2023 Season

2023 Cotton Quality Report

This is a weekly summary of the cotton classed at the Lubbock and Lamesa USDA Cotton Division Cotton Classing Offices for the 2023 production season.

Lamesa’s average daily number of cotton samples received this week is 2,080. The office is currently 89% complete in the classing of their season estimate of samples.

Lubbock’s average daily number of cotton samples received this week is 4,030. The office is 99% complete in the classing of their season estimate of samples.