Welcome to the October 6, 2023 issue of Cotton News, a service provided by Plains Cotton Growers Inc. for the cotton industry in the Texas High Plains and beyond.

Telling the World About Our High Quality Cotton

2023 COTTON USA Orientation Tour Visits West Texas

Textile manufacturing executives representing 15 of the largest cotton consuming countries in the world spent October 5 in Lubbock, Texas, as part of the 2023 COTTON USA Orientation Tour.

The companies represented are expected to consume 5 to 7 million bales of cotton this year, which includes 2.9 million bales from the U.S.

PCG board member Jon Jones, producer in Floyd County, discusses the devestation of the earthquake in Turkey on the textile mill industry with Orhan Buyukerzurumlu, board member of a textile manufacturing company in Turkey.

Meeting in Lubbock for the Texas leg of the tour, participants heard from PCG CEO Kody Bessent on Texas cotton production; CCI Chairman and PCCA Export Sales Manager Carlos Garcia on cotton quality and supply in the Southwest region; Texas Cotton Association President Beau Stephenson on Texas cotton service and logistics; and U.S. Department of Agriculture Agricultural Research Service Cotton Production and Processing Research Unit Leader Greg Holt, Ph.D., on plastic contamination and prevention.

Key takeaways from the presentations included the following:

Texas Cotton Production:

- The Texas High Plains produces 50% to 55% of the state’s cotton, 30% to 35% of the nation’s cotton and 3% to 5% of the world’s cotton.

- The state’s acreage is heavily dependent on rainfall, as 65% of Texas cotton acres are dryland and 35% are partially to fully irrigated.

- The 2022 crop and 2023 crop projection have drastic economic consequences to our region, state and nation.

- Producers have an innovative mindset and are always looking for ways to enhance fiber quality, yield and soil health.

Southwest Quality and Supply

- The Southwest region of the U.S. is known for its quality, sustainability, value and reliability.

- The region has made noticeable improvements in staple length since 2000.

- So far in the 2023/2024 classing season, micronaire is averaging 4.3, strength average is 30.5 and uniformity average is 81.1.

Texas Service and Logistics

- There is estimated to be a smaller Texas crop this year with 4.2 million bales produced.

- The supply chain should have plenty of capacity to handle the 2023 crop.

- When infrastructure depends solely on volume, smaller crop years can have negative economic impacts.

- The U.S. is the only country to have uniform and consistent cotton bale dimensions.

Advances in Contamination Prevention

PCG Chairman Brent Nelson and Secretary/Treasurer Brent Coker discuss Texas High Plains cotton production with Joanne Park, assistant manager for Kyungbang Ltd., a textile mill in Korea. This particular mill’s cotton consumption is around 165,000 bales, 30% of which come from the U.S.

- Systems are put in place for pre-harvest, module handling, module feeding and ginning to prevent contamination.

- The Module Wrap Standard was developed to prevent contamination and provides protection to the industry from inferior module wrap products that are beginning to enter the U.S. market. Module wrap performance standards have three requirements: laboratory testing, field testing and color (certain colors are easier to detect contamination than others).

- The module rotating wheel loader work tool rotates and orients modules into proper position for manual or fixed-position wrap cutting, rather than using a regular forklift.

- None of the research discoveries or recommendations from USDA ARS are patented. They are completely available for industry use.

- Following the morning seminar, participants were able to tour a farm to see best agricultural practices implemented by producers.

The Texas leg of the tour concluded with an industry dinner, where producers and participants were able to connect.

“I really see an improvement in Texas cotton quality the last few years,” one delegate said. “We are grateful for the opportunity to see some of these things in person. As end users, we don’t get to see the process, so it’s valuable to see what cotton growers and infrastructure are doing to ensure high quality cotton.”

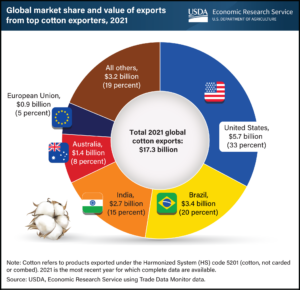

U.S. Cotton Exports Accounted for One-Third of the Global Market’s Value in 2021

The United States is the global leader in cotton exports by value, holding a 33-percent share ($5.7 billion) of the global export market in 2021. U.S. cotton exports expanded to $8.9 billion in 2022 and, while U.S. cotton exports in 2023 are expected to be lower than 2022 levels, USDA’s 10-year projections for U.S. exports indicate growth in the long term. In 2021, the most recent year for which complete global data are available, U.S. exports of cotton totaled nearly 3 million metric tons, 47 percent more volume than the next highest exporter, Brazil. Other major competitors in the global cotton market include Australia, India, and the European Union, with 2021 market shares (in terms of value) ranging from 5% to 15% each, as well as several exporters from Africa, including Benin, Burkina Faso, and Côte d’Ivoire. In addition to maintaining the largest share of the aggregate global market, the United States is a key supplier to several top importer markets. For example, in 2021, U.S. cotton accounted, by value, for 39 percent of cotton imports to China, the top cotton importer in the world. Other top destinations for U.S. cotton exports include Vietnam, Turkey, Pakistan, and Mexico. These countries combined with China, accounted for more than 70 percent of U.S. cotton exports in 2021.