Welcome to the September 22, 2023 issue of Cotton News, a service provided by Plains Cotton Growers Inc. for the cotton industry in the Texas High Plains and beyond.

The Canary in the Coal Mine is Not Supply

Lou Barbera Provides Cotton Market Overview

“China has been importing less cotton than ever since 2011,” said VLM Commodities Managing Partner and Analyst Lou Barbera, who presented an overview on the cotton market this morning (September 22, 2023) to the Plains Cotton Advisory Group. “The U.S. particularly has been losing market share at the same time from what China has been importing for the last two years.”

He went on to add that part of the reason for this is that the U.S. has grown less — the last two crop years in the High Plains is indicative of that. However, Barbera said it comes down to two factors: price and availability.

While China’s decline is a concern, other countries have increased consumption and are growing fast. The problem, according to Barbera, is that, for the first time ever, Australia and Brazil are larger exporters of cotton than the U.S.

“In fact, Brazil should overtake us this year as the single largest exporter of cotton,” he added.

Price Factor

Barbera argues that price is the main character in this scenario, even when other factors come into play.

“I understand the reasoning that many people have this time of year, which is that U.S. supply isn’t there,” he said. “And this is a valid argument considering the last two years of horror shows the U.S. has experienced with production.”

However, supply or no supply, the prices that Brazil can grow cotton at is not a price the U.S. farmer can take and remain in long-term operation. And it’s this price that will cause an increase in production — and exports — for the Brazilian grower.

Supply Factor

“Supply has been the focus this entire year,” Barbera said. “Yet, 85.50 has been a magnet for the market. It seems to me that this is the halfway point of what people believe to be cheap and expensive.”

Supply is a double-edged sword. While there is a little in the U.S. right now, there is going to be a lot coming at us very soon. At our current level of 90 million bales of ending stocks in the world, 90 cents is rich historically. “We are still trying to talk down supply after losing 4 million bales of production in 2.5 months from the World Agricultural Supply and Demand Estimates Report.”

Barbera uses this information to prove his point that supply might not matter as much as we think.

“This was the largest 2-month reduction of the crop on record and the largest September cut ever at 6.15% in the U.S.,” he said. “Yet…prices are unchanged.”

Demand Factor

Barbera said that one of the best things cotton has going for it is the immense amount of data available from various sources to analyze. The on-call report is the one thing that is almost exclusive to cotton and gives a real-time look at demand — which has a much larger influence on prices than anything else.

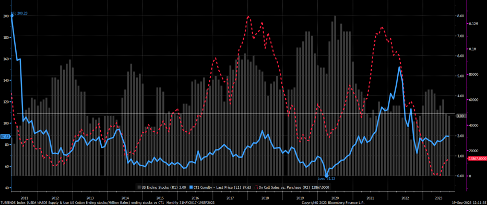

Barbera constructed an on-call sales (mills) versus on-call purchases (growers – red dashed line) chart [See Figure 1] showing the on-call imbalance. “Throughout history, the higher the mill-to-grower unfixed price imbalance, the more bullish the market seems to get,” Barbera said. “Currently we are at the lowest differential on record for this time of year at approximately 13,000 contracts.” He went on to add that during our strongest rallies in the past, we have been over 100,000 contracts.

“This tells us that there has never been a larger number of growers with cotton to fix than currently,” Barbera said. “And that is what I would call the real canary in the coal mine.”

Figure 1

What Needs to Happen From This Point Forward

According to Barbera, we are going to have to answer some questions about what the U.S. is willing to do to take market share back in the cotton industry and the fiber industry as a whole.

“In the short-term, cotton’s situation comes down to pricing,” Barbera said. “The fact that the board is building carry (carry indicates that the bales coming in don’t have a buyer) is a warning sign to all that are willing to listen.”

Barbera added concerns for the mid-south crop, which shows a 37 staple — a pricey bale to begin with not including the other factors at play right now.

Toward the end of Barbera’s presentation, he expressed the need to spread the message of the quality of U.S. cotton as well as promoting sustainable fibers and best production practices.

“It doesn’t make sense to me that we are unable to grab market share in the U.S., given the practices of other countries,” he added. “Our consumers, especially our younger generations, need to hear from you now. I live in New York and I see how your consumers think and behave. They will care about this and it will affect their purchasing choices if we tell them. Shout it from the rooftops.”