Welcome to the July 7, 2023 issue of Cotton News, a service provided by Plains Cotton Growers Inc. for the cotton industry in the Texas High Plains and beyond.

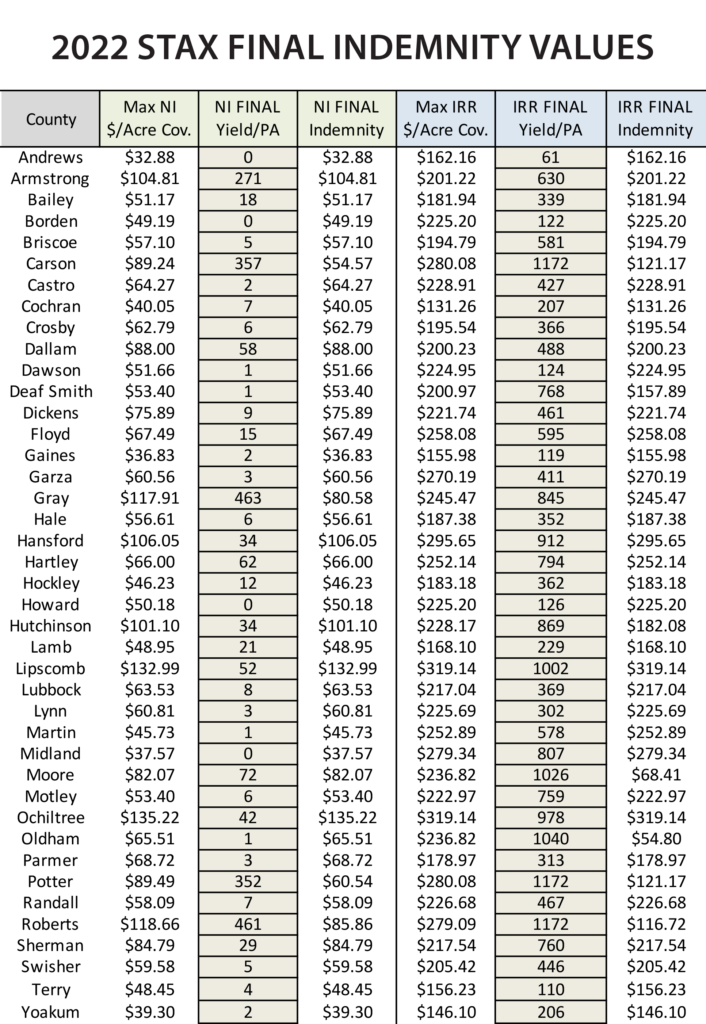

Property Tax Relief Legislation Breakdown

On June 27, 2023, Gov. Greg Abbott called a second extraordinary session of the 88th Texas Legislature to convene to consider and act upon two items:

- Legislation to cut property tax rates solely by reducing the school district maximum compressed tax rate to provide lasting property tax relief for Texas taxpayers; and

- Legislation to put Texas on a pathway to eliminating school district maintenance and operations property taxes.

In response to the called extraordinary session, both the Senate and House have filed and acted upon their respective bill versions through Senate Bill 1 and House Bill 1. Currently SB1 is now awaiting action by the House and HB1 is awaiting action by the Senate to resolve differences between the two bills.

Based on information received, the comparison chart below shows the two bill versions side-by-side and their approaches to addressing the Governor’s action items.

Source: Legislative Budget Board

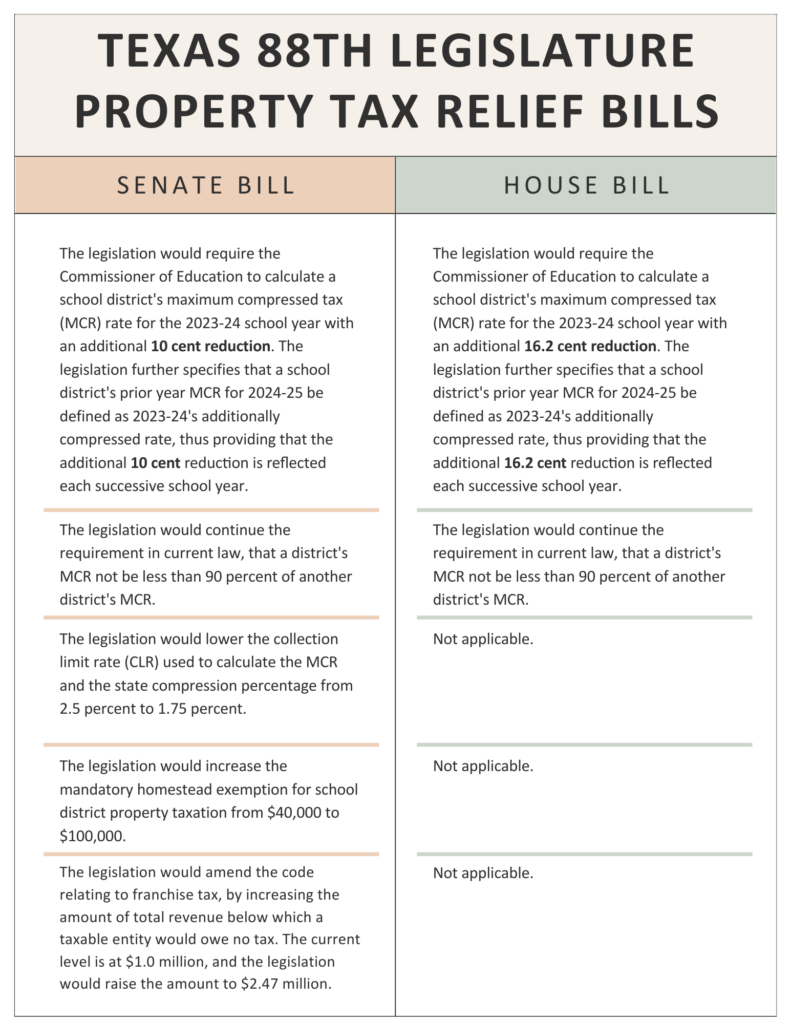

2022 Final County Yields Announced; STAX and SCO Payments Going Out

Following announcement of final 2022 county yields for Upland cotton on June 22, 2023, the USDA Risk Management Agency has begun sending final indemnity payments to Upland cotton producers who purchased 2022 crop year Supplemental Coverage Option (SCO) or Stacked Income Protection Plan (STAX) policies. For most of Texas the combination of below average yields and Upland cotton harvest prices set the stage for both SCO and STAX payments to be triggered in most counties.

Looking specifically at 2022 STAX policies purchased in PCG’s service area, all of PCG’s member counties triggered STAX indemnities at some level. The amount of loss across the region varied significantly. Several counties in the northern part of the High Plains triggered less than maximum payments, while other counties triggered maximum payments for both irrigated and dryland practices.

Reviewing the counties individually shows three High Plains counties (Potter, Roberts and Carson) that triggered STAX payments at less than maximum levels for both irrigated and dryland acres. Four other High Plains counties (Deaf Smith, Hutchinson, Moore and Oldham) triggered a maximum payment for non-irrigated cotton, but less than the maximum payment for the irrigated practice. One county (Gray) triggered a maximum irrigated STAX indemnity, but less than a maximum payment on non-irrigated acres.

Click on the chart below to download a PDF version.

*Maximum payments calculated using x1.2 Protection Factor