Welcome to the April 28, 2023 issue of Cotton News, a service provided by Plains Cotton Growers Inc. for the cotton industry in the Texas High Plains and beyond.

Producer Perspectives on the 2023 Farm Bill

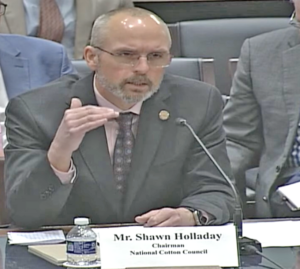

Shawn Holladay, producer in Dawson County, PCG past president and current chair of the National Cotton Council, testifies on behalf of the U.S. cotton industry at the House Ag Committee Subcommittee on General Farm Commodities, Risk Management and Credit’s hearing, “Producer Perspectives on the 2023 Farm Bill.”

The House Agriculture Subcommittee on General Farm Commodities, Risk Management and Credit held a hearing Wednesday, April 26, 2023, to review producers’ needs for the upcoming Farm Bill.

Among the witnesses was Shawn Holladay, Dawson County producer, PCG past president and current chair of the National Cotton Council.

In Holladay’s opening statement, he emphasized key priorities of the Farm Bill that would be beneficial to the U.S. cotton industry.

Seed cotton reference price

“Since 2018, cotton costs of production have increased by 20 cents per pound, based on average yields of 800 pounds per acre,” Holladay. “For many producers, total production costs now range between 90 cents and $1 per pound, which exceed current futures prices trading in the mid-80s.” When calculated based on seed cotton, the total costs to produce a pound of seed cotton have risen nearly 9 cents since the 2018 Farm Bill, with current costs of production at almost 48 cents.

This is far above the seed cotton reference price of 36.7 cents per pound.

“The current reference prices were set in the 2014 Farm Bill using 2012 data, which is outdated,” said Rep. Austin Scott (R-Ga.), subcommittee chair. “Even three years old would be too old at this point, given the increase in input prices.”

When Scott asked for the break-even cotton lint price producers need in relation to the seed cotton reference price, Holladay answered: “To break even, a producer would need a 85 cent to 95 cent lint price depending on what all he put into his crop.”

Multiple Representatives sitting on the subcommittee made mention of reference prices and the need to raise them to alleviate financial strain on producers.

Crop insurance

Currently, producers enrolled in the Agriculture Risk Coverage (ARC) or Price Loss Coverage (PLC) programs are limited in their access to crop insurance, “due to a prohibition on the purchase of the Stacked Income Protection Plan (STAX) on their enrolled farm,” Holladay said. “At the beginning of the prohibition, during the 2019 crop year, most growers chose to enroll their base acres in PLC. However, with higher cotton futures prices for the 2021 and 2022 crops, and limited effectiveness of the current seed cotton reference price, STAX has become a more attractive option.

Holladay emphasized to the subcommittee that producers should be able to manage risk based on the needs of their operation. Eliminating the prohibition on simultaneous enrollment in PLC and STAX, as well as boosting the top coverage level of STAX for those farms with no seed cotton base — or who forego enrollment in ARC/PLC — would allow them to tailor their risk management options according to the needs of their operation. In turn, this will also decrease producers’ reliance on ad hoc programs, putting producers in charge of their own production risks.

Cotton loan programs

Mr. Scott also asked Holladay about the effectiveness of raising loan rates.

“We use the marketing loan frequently in cotton,” he responded. “Most of our cotton is exported, so we experience unique issues in terms of shipping, storage and marketing.” He went on to say that raising the loan rate would not be a large cost item to Congress, yet would have a significant impact on the amount of working capital producers can obtain when prices have dipped to break-even or lower.”

Even in times of higher market prices, the marketing loan programs are utilized by the cotton industry to provide cash flow for producers and flexibility in marketing to encourage orderly movement of the crop throughout the year.

Despite higher production costs, the maximum level of the loan rate has remained at 52 cents since 2002.

Holladay said the level of the loan rate should be increased to better reflect current costs of production and recent market prices.

“In addition, loan repayment provisions should be modernized to better reflect the competitive landscape in the global market and the higher storage and logistics costs facing the industry,” he added.

While the hearing was divided into two different segments totaling more than six hours of discussion, subcommittee members were eager to hear how they could better serve Rural America.

As House Agriculture Committee Chair Glenn “GT “ Thompson (R-Pa.) stated in his opening remarks of the hearing, “To get the policy right, we need to hear directly from the voices in the countryside rather than the (Washington D.C.) Beltway.”

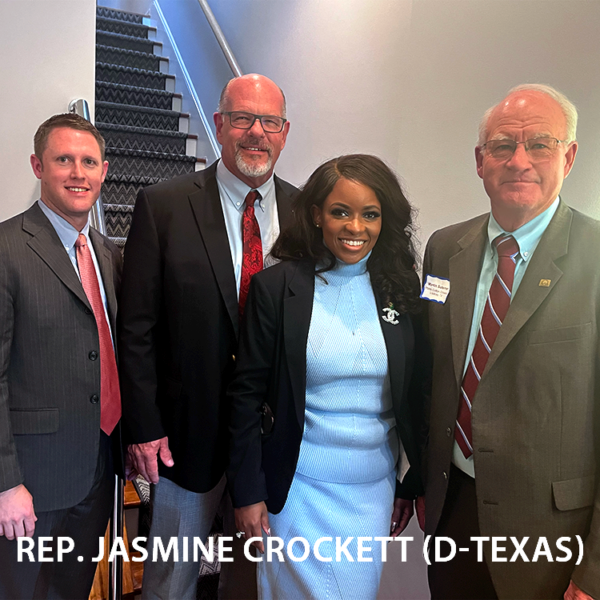

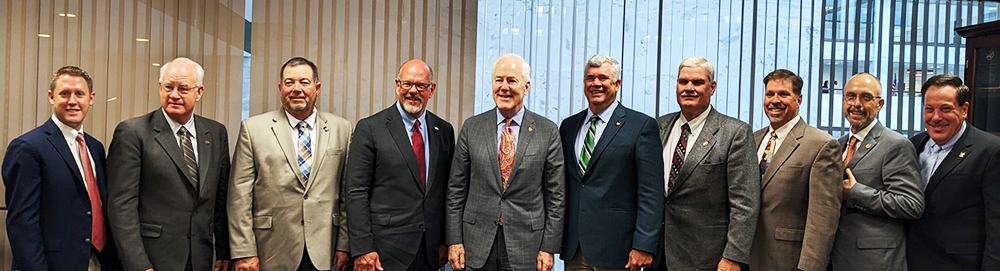

PCG in DC

PCG CEO Kody Bessent, PCG President Martin Stoerner, STCGA President Paul Freund, PCG Executive Committee Member Steve Olson, Sen. John Cornyn (R-Texas), STCGA Board Member Jon Whatley, SRPCGA Board Member Doyle Schniers, STCGA Board Member Matt Huie, NCC Chair Shawn Holladay and STCGA Executive Director Jeff Nunley.

PCG joined South Texas Cotton and Grain Association (STCGA), Southern Rolling Plains Cotton Growers Association (SRPCGA) and the National Cotton Council (NCC) at the U.S. Capitol to advocate for a strong 2023 Farm Bill this week.

“It was an effective trip and one of many to come as the 2023 Farm Bill process is fully underway,” Bessent said. “We appreciate STCGA, SRPCGA and the NCC for their partnership on this trip and their efforts in emphasizing the need for strong farm policy for the cotton industry nationwide.”