If you haven’t read PCG CEO Kody Bessent’s take on the new 2022 Emergency Relief Program, click here.

DATES: Funding availability: Application period for Track 1 will begin October 31, 2023. Application period for Track 2 will begin October 31, 2023. Contact your local FSA office for instructions on how to apply for Track 2 — FSA will be mailing out pre-filled applications for Track 1. You may still apply for Track 1 if you do not receive a pre-filled application.

COMMENTS: The U.S. Department of Agriculture Farm Service Agency will consider comments received by January 2, 2024.

ADDRESSES: You may submit comments by the following method: Federal eRulemaking Portal: Go to https://www.regulations.gov and search for Docket ID FSA–2023–0020.

You may also send comments to the Desk Officer for Agriculture, Office of the Information and Regulatory Affairs, Office of Management and Budget, Washington, DC 20503. Comments will be available for public inspection online at https://www.regulations.gov.

Track Overview

Track 1 will provide a streamlined application process for eligible crop and tree losses during the 2022 or 2023 crop years for which a producer had:

-A Federal crop insurance policy that provided coverage for crop production losses or tree losses related to the qualifying disaster events and received an indemnity for a crop and unit, excluding:

- crops with an intended use of grazing,

- livestock policies,

- forage seeding,

- Margin Protection Plan policies purchased without a base policy,

- banana plants insured under the Hawaii Tropical Trees provisions, and

- policies issued in Puerto Rico; or

-NAP coverage and received a NAP payment for a crop and unit, excluding crops with an intended use of grazing. The applicable Federal crop insurance policies and NAP provide payments to producers for crop and tree losses due to eligible causes of loss, as defined in the producer’s Federal crop insurance policy or NAP regulations and basic provisions. RMA and FSA are using data submitted by producers for Federal crop insurance or NAP purposes to calculate a producer’s eligible loss under Track 1. The Track 1 payment calculation is intended to compensate eligible crop and tree producers for a percentage of that loss determined by the applicable ERP factor, which varies based on the producer’s level of Federal crop insurance or NAP coverage.

Track 2 will provide assistance for eligible revenue, production, and quality losses of eligible crops not included in Track 1 — similar to Phase 2 of the previous ERP program. FSA has determined that the best estimation of such losses is a producer’s decrease in disaster year revenue compared to a benchmark year revenue, where benchmark year revenue represents a producer’s revenue prior to the impact of the qualifying disaster event.

Payment Factoring

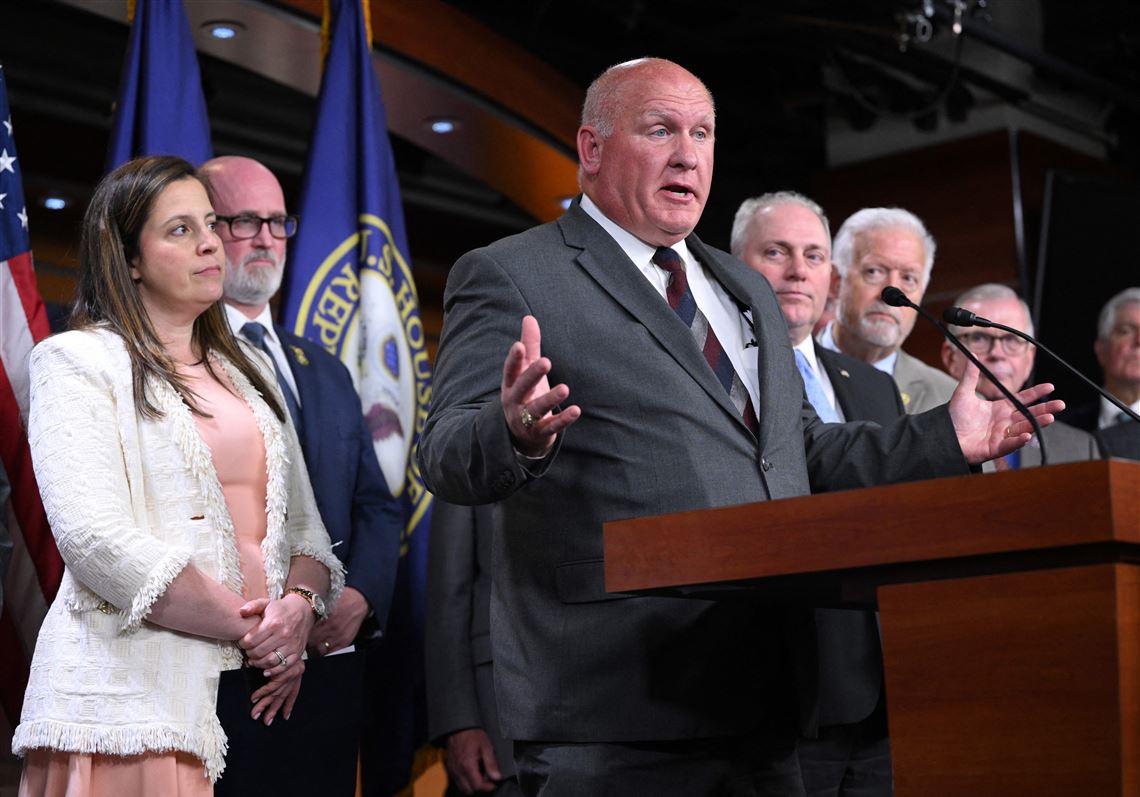

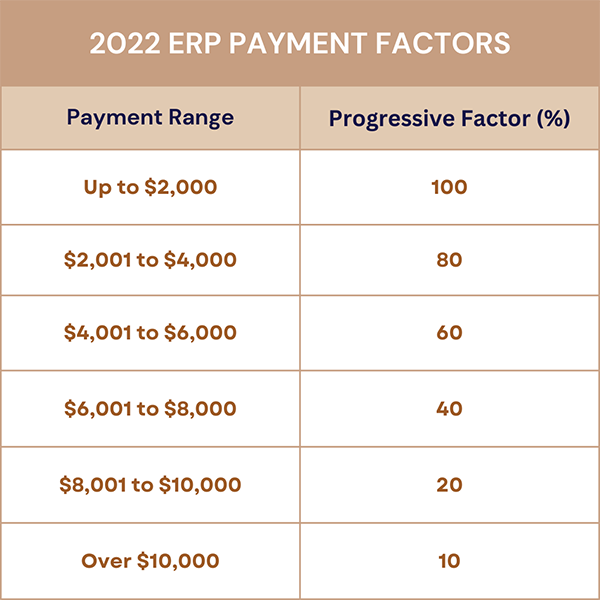

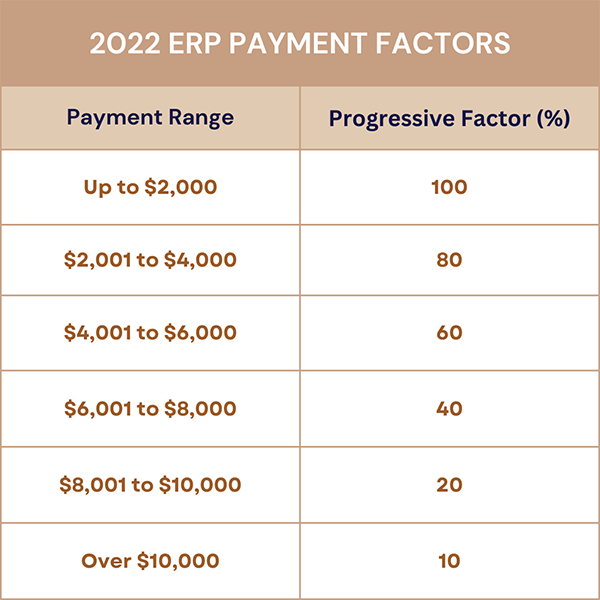

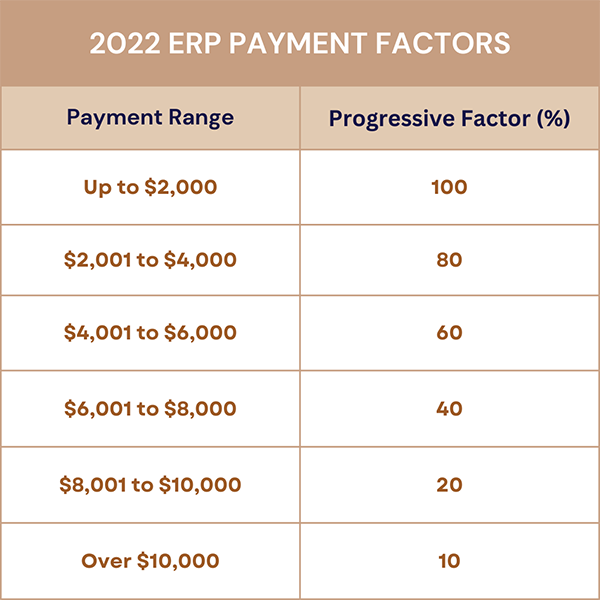

According to the notice issued by USDA, progressive factoring will be used to calculate payments. See figure 1.

Figure 1 (click on image to download)

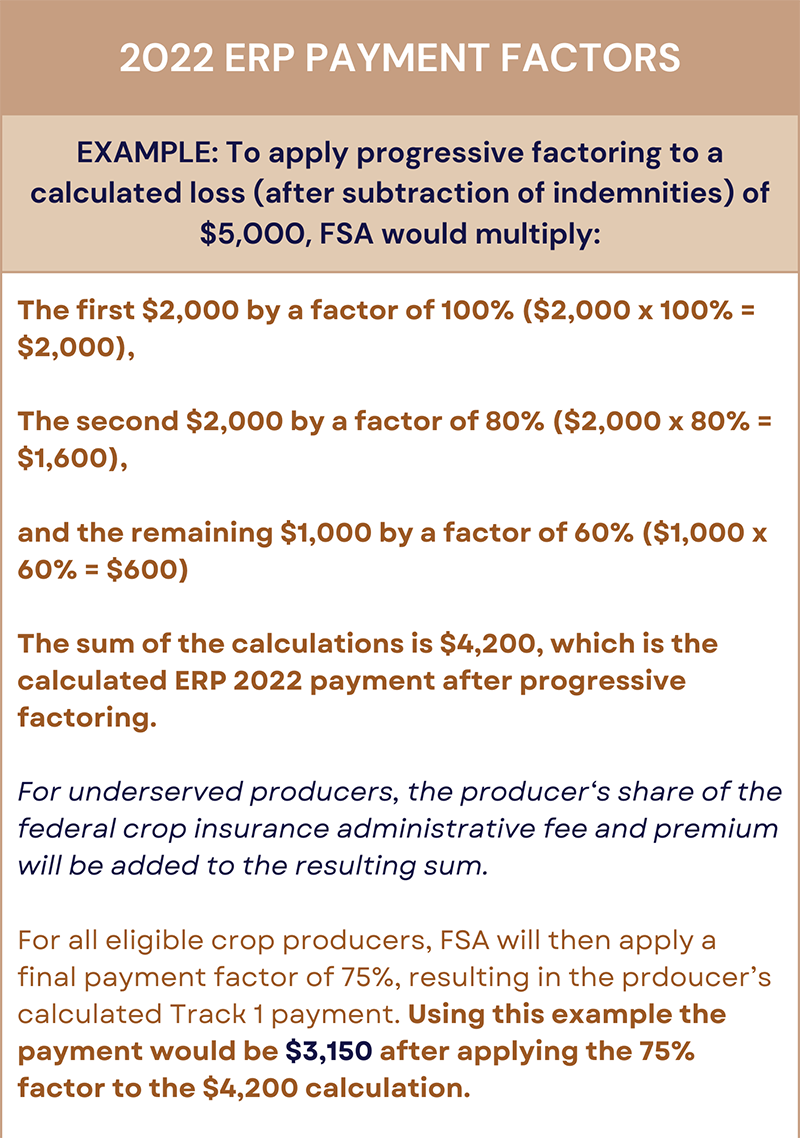

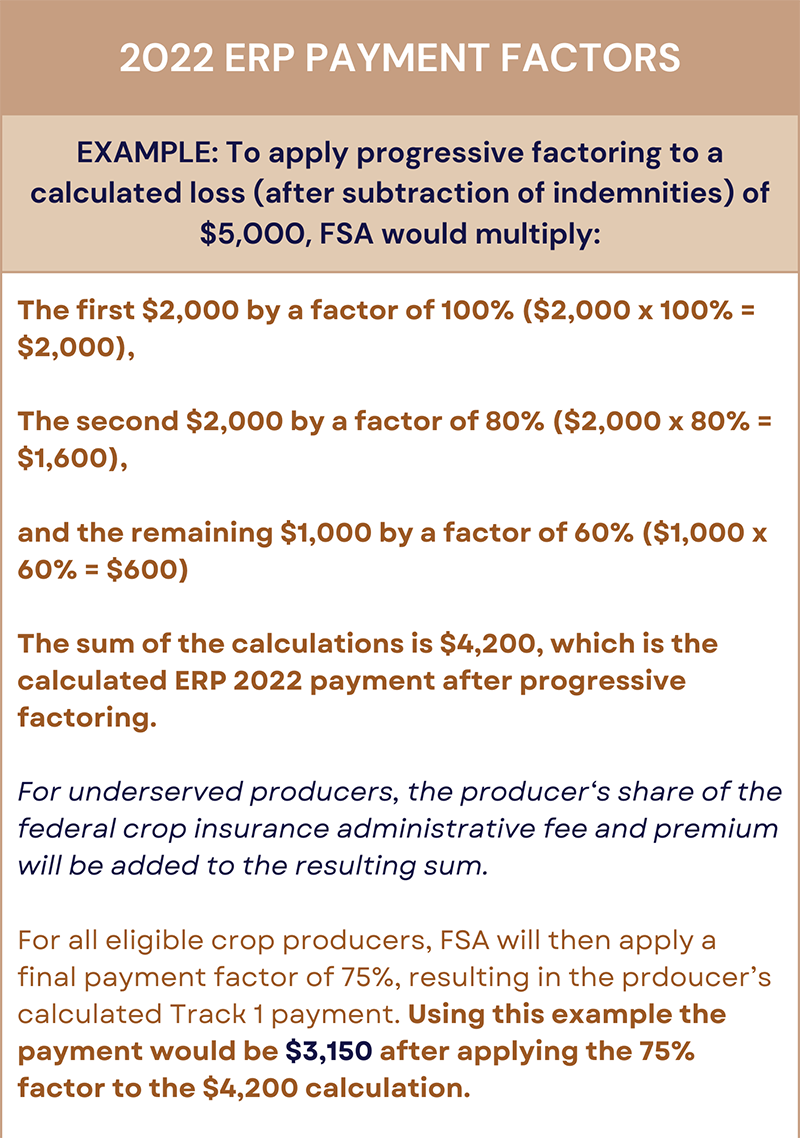

The basic examples used by the notice break down how payments will be calculated.

For example, to apply progressive factoring to a calculated loss (after subtraction of indemnities) of $5,000, FSA would multiply:

- the first $2,000 by a factor of 100 percent ($2,000 × 100% = $2,000),

- the second $2,000 by a factor of 80 percent ($2,000 × 80% = $1,600), and

- the remaining $1,000 by a factor of 60 percent ($1,000 × 60% = $600).

The sum of those calculations is $4,200, which is the calculated ERP 2022 payment after progressive factoring.

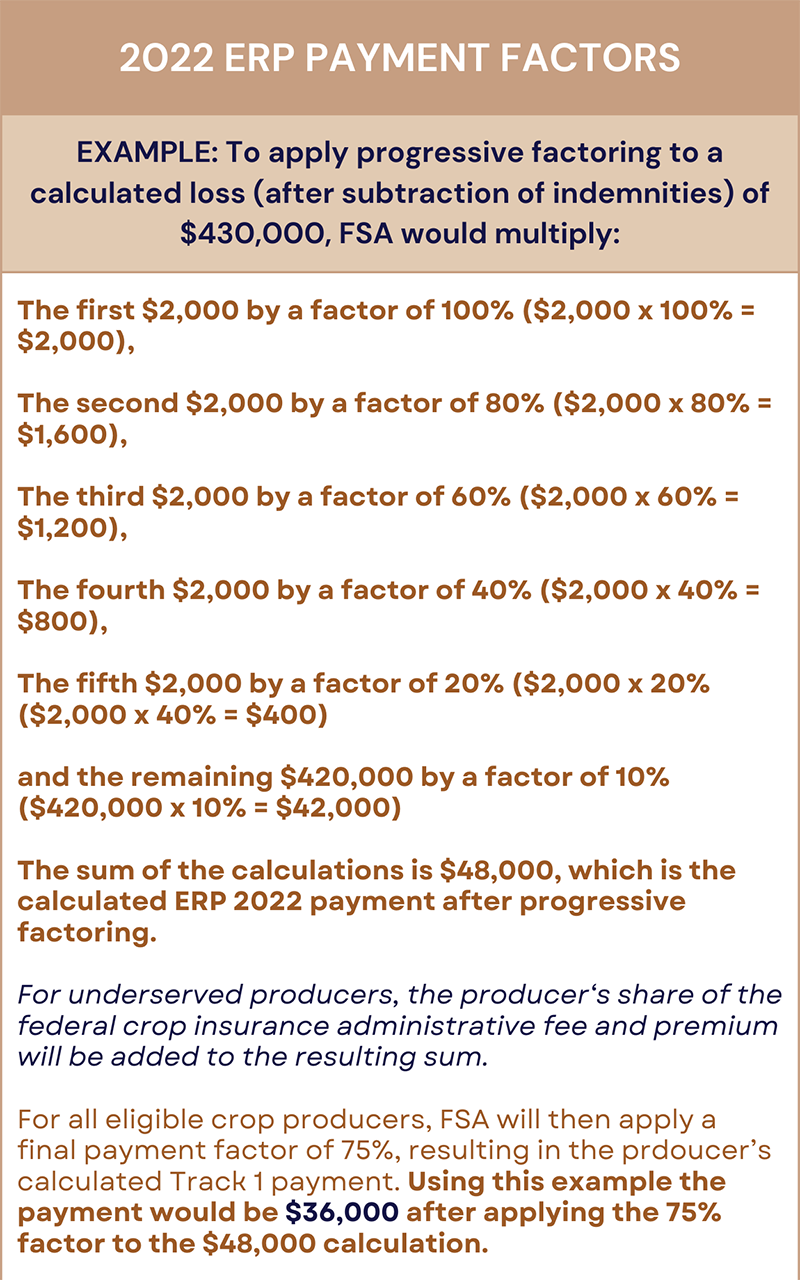

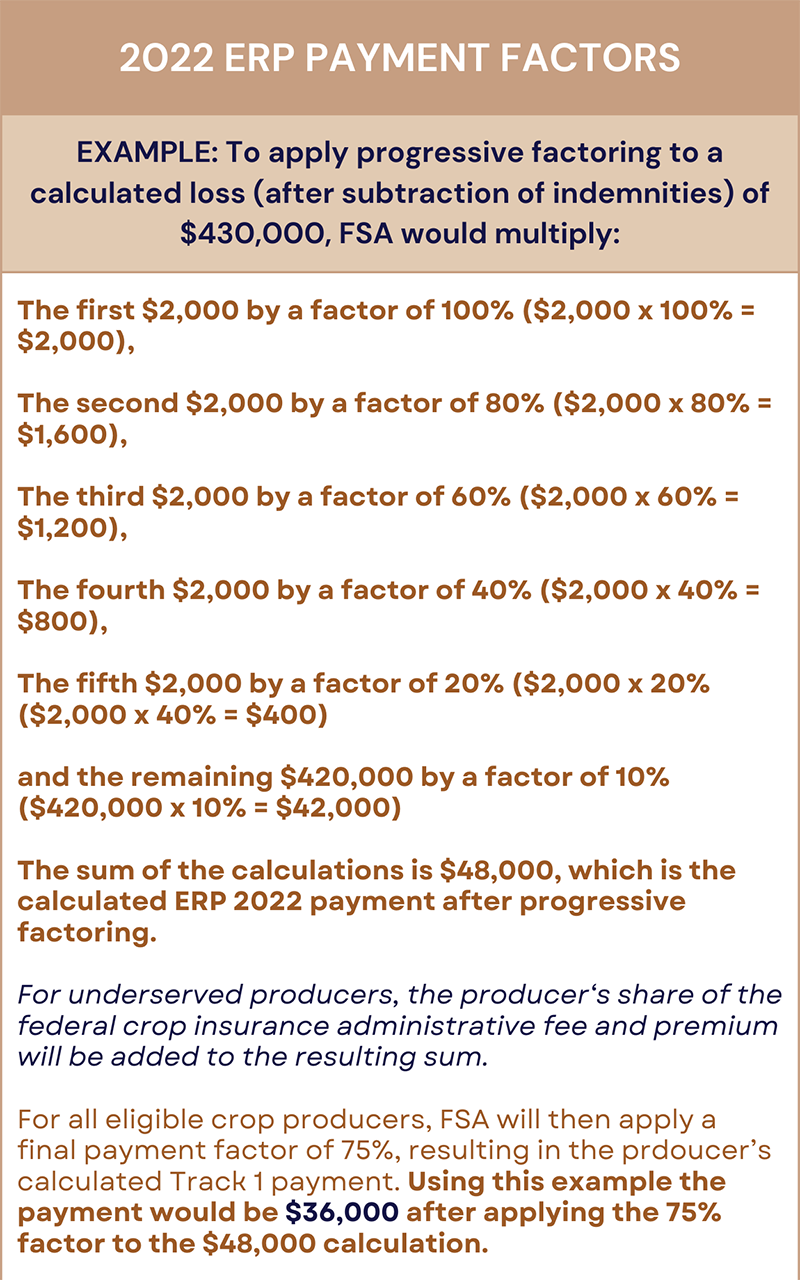

For another example, to apply progressive factoring to a calculated loss (after subtraction of indemnities) of $430,000, FSA would multiply:

- the first $2,000 by a factor of 100 percent ($2,000 × 100% = $2,000),

- the second $2,000 by a factor of 80 percent ($2,000 × 80% = $1,600),

- the third $2,000 by a factor of 60 percent ($2,000 × 60% = $1,200),

- the fourth $2,000 by a factor of 40 percent ($2,000 × 40% = $800),

- the fifth $2,000 by a factor of 20% ($2,000 × 20% = $400), and

- the remaining $420,000 by a factor of 10 percent ($420,000 × 10% = $42,000).

The sum of those calculations is $48,000, which is the calculated ERP 2022 payment after progressive factoring.

For underserved producers, the producer’s share of the Federal crop insurance administrative fee and premium will be added to the resulting sum.

For all eligible crop producers, FSA will then apply a final payment factor of 75 percent, resulting in the producer’s calculated Track 1 payment. So in the example above, the $48,000 calculation will be factored by 75% resulting in a payment of $36,000 to the producer. We’ve provided visual aids below, which are available for download.

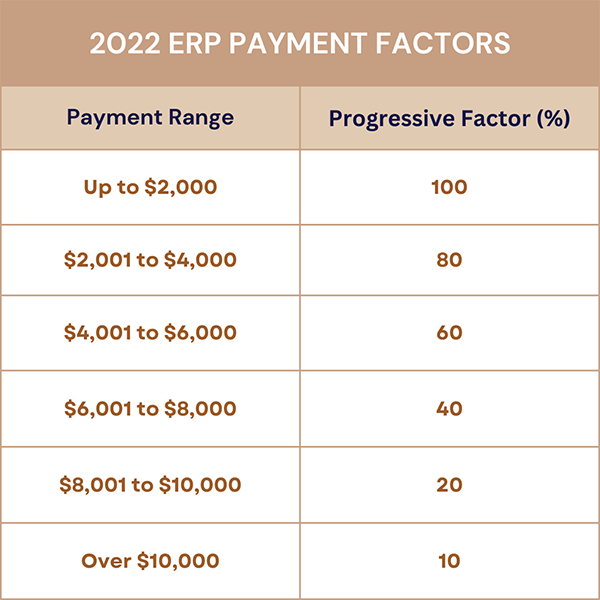

Click on the image to download.

Click on the image to download.