How Does the Inflation Reduction Act Affect the Producer?

The Senate and House passed the Inflation Reduction Act of 2022, which was signed into law by President Joe Biden on August 16, 2022.

While it is a very robust piece of legislation, the two main questions we continue to receive are:

- Is there any relief for agriculture in the legislation?

- What if any are the tax implications on myself/family or my operation going forward?

Below is a summary of some of the key ag related provisions per Congressional Research Service (CRS) reports along with some of the tax provisions that we continue to review and digest with other coalitions. We will circle back with updates and corrections as they become available.

Right now, there are very limited agriculture provisions that producers will be able to capture other than conservation programs, which is determined by the direction of the individual operation. It is our understanding that there should be minimal tax implications to production agriculture subject to further review of the bill and how IRS interprets the Act through rule making provisions.

Agricultural Conservation

The Inflation Reduction Act provides $19.5 billion for agricultural conservation. It adds over $18 billion in additional funding for existing farm bill conservation programs, including:

- Environmental Quality Incentives Program (EQIP; $8.45 billion)

- Regional Conservation Partnership Program (RCPP; $4.95 billion)

- Conservation Stewardship Program (CSP; $3.25 billion)

- Agricultural Conservation Easement Program (ACEP; $1.40 billion).

These programs provide financial and technical assistance to private landowners to voluntarily implement conservation practices on agricultural land. Program funds will be directed to climate-change-related goals and will prioritize mitigation activities.

Agricultural Credit

The Inflation Reduction Act provides debt relief for distressed farm borrowers and assistance for underserved farmers and ranchers. These provisions would replace similar provisions from the American Rescue Plan Act (ARPA) that were blocked by the courts because the relief was found to be race-based and not narrowly tailored to meet a compelling state interest. It would use budgetary offsets of about $6 billion that would be rescinded or repurposed from the ARPA funding.

The new debt relief program provides $3.1 billion for debt modifications, including debt forgiveness, for “distressed borrowers” of U.S. Department of Agriculture (USDA) Farm Service Agency direct or guaranteed farm loans “whose agricultural operations are at financial risk.” USDA is expected to develop the criteria for eligibility once the legislation is enacted.

The bill also includes nearly $2.9 billion to help underserved farmers, ranchers, and forest landowners, defined to include those living in high poverty areas, veterans, limited resource producers, and beginning farmers and ranchers.

Most of this assistance ($2.2 billion) is designated for those who experienced discrimination before 2021 in USDA farm lending programs. Individual payments for discrimination would be limited to $500,000 and are to be administered by nongovernmental entities selected and overseen by USDA.

The bill also provides:

- $125 million for technical assistance, outreach, and mediation.

- $250 million for land loss assistance, such as heirs’ property and fractionated land.

- $250 million for agricultural education emphasizing scholarships and career development at historically Black, tribal, and Hispanic colleges.

- $10 million for equity commissions at USDA.

Corporate Tax Reform

The Inflation Reduction Act implements a provision that would impose a new alternative minimum tax of 15% on corporations based on financial income.

It would apply to corporations with $1 billion or more in average annual earnings in the previous three years.

In the case of U.S. corporations that have foreign parents, it would apply only to income earned in the United States of $100 million or more of average annual earnings in the previous three years (and apply when the international financial reporting group has income of $1 billion or more). It would apply to a new corporation in existence for less than three years based on the earnings in the years of existence.

The provision would exclude:

- Subchapter S corporations

- Regulated investment companies (RICs)

- Real estate investment trusts (REITs).

The tax would apply to large private equity firms organized as partnerships but excludes portfolio companies owned by these firms.

Firms that file consolidated returns would include income allocable to the firm from related firms including controlled foreign corporations (and any disregarded entities). For other related firms, dividends would be included. The provision would allow special deductions for cooperatives and Alaska Native Corporations. It would make adjustments to conform financial accounting to tax accounting for certain defined benefit pension plans. It would apply with respect to items under the unrelated business income tax for tax-exempt entities.

Financial income would be adjusted to allow depreciation deductions based on tax rules. It would also be adjusted to allow recovery of wireless spectrum rights as allowed under tax rules (recovered over 15 years).

The additional tax would equal the amount of the minimum tax in excess of the regular income tax plus the additional tax from the Base Erosion and Anti-Abuse tax. Income would be increased by federal and foreign income taxes to place income on a pretax basis.

Losses would be allowed in the same manner as with the regular tax, with loss carryovers limited to 80% of taxable income.

Domestic credits under the general business tax (such as the R&D credit) would be allowed to offset up to 75% of the combined regular and minimum tax. Foreign tax credits would be allowed based on the allowance for foreign taxes paid in a corporation’s financial statement.

A credit for additional minimum tax could be carried over to future years to offset regular tax when that tax is higher. This tax would apply to taxable years beginning after December 31, 2022.

Extension of Limitation on Excess Business Losses of Noncorporate Taxpayers

The Inflation Reduction Act extends the limitation on excess business losses of noncorporate taxpayers. Businesses are generally permitted to carry over a net operating loss (NOL) to certain past and future years.

Under the passive loss rules, individuals and certain other taxpayers are limited in their ability to claim deductions and credits from passive trade and business activities, although unused deductions and credits may generally be carried forward to the next year. Similarly, certain farm losses may not be deducted in the current year but can be carried forward to the next year.

For taxpayers other than C corporations, a deduction in the current year for excess business losses is temporarily disallowed (through 2026) and such losses are treated as a NOL carryover to the following year.

An excess business loss is the amount that a taxpayer’s aggregate deductions attributable to trades and businesses exceed the sum of:

- Aggregate gross income or gain attributable to such activities.

- $250,000 ($500,000 if married filing jointly), adjusted for inflation.

For partnerships and S corporations, this provision was applied at the partner or shareholder level. This provision would extend the temporary limitation through 2028.

IRS Enforcement Provisions

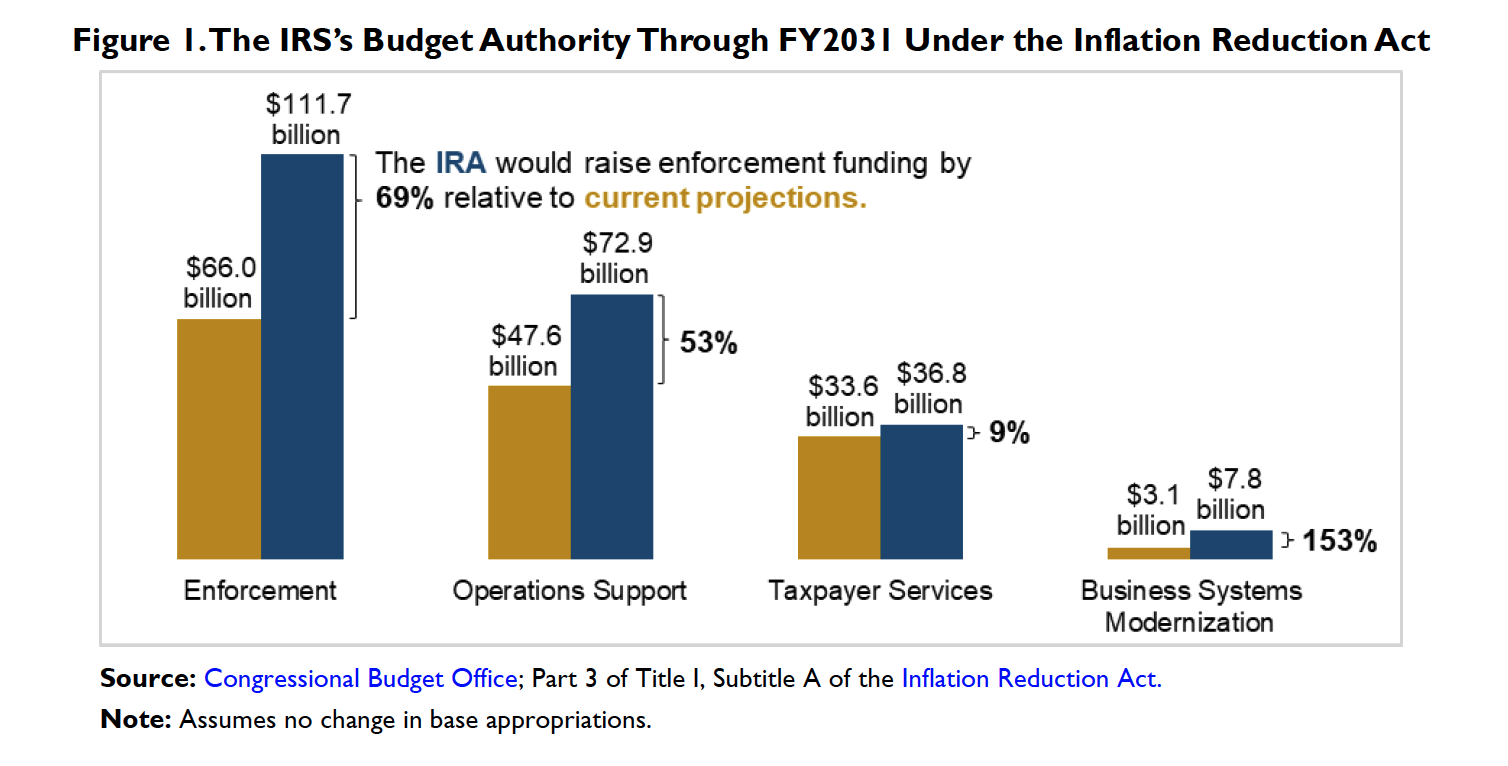

The Inflation Reduction Act provides the IRS $45.6 billion for tax enforcement activities such as hiring more enforcement agents, providing legal support, and investing in “investigative technology.”

The funds could also be used to monitor and enforce taxes on digital assets such as cryptocurrency. The recently passed Infrastructure Investment and Jobs Act required cryptocurrency brokers to report more information on their clients’ trading activity to the IRS starting in 2023.

IRS Operations Support

For operations support under the IRA, $25.3 billion was appropriated to the IRS. This funding would cover routine costs such as rent, facilities, printing, postage and security, as well as telecom and information technology. These funds could also go toward research and the IRS Oversight Board, which oversees and guides the IRS.

Taxpayer Services

The Inflation Reduction Act appropriates $3.2 billion for taxpayer services such as filing and account services, prefiling assistance and education. The IRS has struggled to provide quality service during the COVID-19 pandemic.

The number of unprocessed tax returns at the end of the filing season rose from 7.4 million in 2019 to 35.8 million in 2021 and 13.3 million in 2022. Phone service also suffered. Whereas IRS customer service representatives answered 59% of phone calls they received in 2019, they answered 19% and 18% in 2021 and 2022, respectively.

In addition, the IRS receives $15 million under this bill to fund a task force that would study the cost and feasibility of creating a free direct e-file program. The agency previously committed not to create its own tax filing software as part of an alliance called the Free File Program.

In exchange, private tax filing software companies agreed to provide free services to low- and moderate-income taxpayers. Roughly 4% of eligible taxpayers used the Free File Program’s private providers to file their taxes in 2020.

Business System Modernization

The IRS also receives $4.8 billion for its Business Systems Modernization project under this bill. In 2019, the IRS released a plan to upgrade the business systems it uses to administer taxpayer services, operations, and cybersecurity. These additional funds could be invested in customer service technology such as automated callback systems for phone lines, but not used to operate legacy systems.

Sources:

- Congressional Research Service Reports: IN11978 Inflation Reduction Act: Agriculture Conservation and Credit, Renewable Energy, and Forestry

- R47202 Tax Provisions in the Inflation Reduction Act of 2022

- IN11977 IRS-Related Funding in the Inflation Reduction Act

ERP Phase 1B Applications Mailed Out

The U.S. Department of Agriculture (USDA) today announced another installment (phase) in assistance to commodity and specialty crop producers impacted by natural disaster events in 2020 and 2021. More than 18,000 producers will soon receive new or updated pre-filled disaster applications to offset eligible crop losses. Approximately $6.4 billion has already been distributed to 261,017 producers through USDA’s Farm Service Agency’s (FSA) Emergency Relief Program (ERP).

“We knew when we announced ERP in May that we would have additional applications to send toward the end of the summer as we received new information, and we came to know of producers who were inadvertently left out of the first data set we used,” said USDA Under Secretary for Farm Production and Conservation Robert Bonnie. “I am proud of our team’s continued effort to capture additional insurance records to enable over 18,000 producers to receive new or updated pre-filled disaster applications to provide much needed financial relief.”

FSA will begin mailing pre-filled applications in late August to producers who have potentially eligible losses and:

- Received crop insurance indemnities for qualifying 2020 and 2021 disaster events after May 2, 2022.

- Received crop insurance indemnities associated with Nursery, Supplemental Coverage Option (SCO), Stacked Income Protection Plan (STAX), Enhanced Coverage Option (ECO) and Margin Protection (MP) policies.

- New primary policyholders not included in the initial insured producer Phase 1 mailing from May 25, 2022, because their claim records had not been filled.

- Certain 2020 prevent plant losses related to qualifying 2020 disaster events that had only been recorded in crop insurance records as related to 2019 adverse weather events and, as such, were not previously provided in applications sent earlier this year.

- New Substantial Beneficial Interest (SBI) records, including SBIs where tax identification numbers were corrected.

Producers are expected to receive assistance direct deposited into their bank account within three business days after they sign and return the pre-filled application to the FSA county office and the county office enters the application into the system.

Before applying any program payment factors or eligibility criteria, it is estimated that this next installment (phase) may generate about $756 million in assistance.

Emergency Relief Payments to Date

This emergency relief under ERP complements ERP assistance recently provided to more than 167,000 producers who had received crop insurance indemnities and Noninsured Crop Disaster Assistance Program (NAP) payments for qualifying losses. USDA has processed more than 255,000 applications for ERP, and to date, has made approximately $6.4 billion in payments to commodity and specialty crop producers to help offset eligible losses from qualifying 2020 and 2021 natural disasters. Also, earlier this year, staff processed more than 100,000 payments through the Emergency Livestock Relief Program (ELRP) and paid eligible producers more than $601.3 million for 2021 grazing losses within days of the program announcement.

Phase Two

The second phase of both ERP and ELRP will be aimed at filling gaps and provide assistance to producers who did not participate in or receive payments through the existing risk management programs that are being leveraged for phase one implementation. USDA will keep producers and stakeholders informed as program details are made available.

More Information

In addition, on Aug. 18, 2022, USDA published a technical correction to the Notice of Funds Availability for ERP and ELRP to clarify how income from the sale of farm equipment and the provision of production inputs and services to farmers, ranchers, foresters, and farm operations are to be considered in the calculation of average adjusted gross farm income. Producers whose average adjusted gross farm income is at least 75% of the producer’s the average Adjusted Gross Income can gain access to a higher payment limitation.

ERP and the previously announced ELRP are authorized by the Extending Government Funding and Delivering Emergency Assistance Act, which President Biden signed into law in 2021. The law provided $10 billion to help agricultural producers impacted by wildfires, droughts, hurricanes, winter storms and other eligible disasters experienced during calendar years 2020 and 2021.

For more information on ERP and ELRP eligibility, program provisions for historically underserved producers as well as Frequently Asked Questions, producers can visit FSA’s Emergency Relief webpage. Anew public-facing dashboard on the ERP webpage has information on ERP payments that can be sorted by crop type – specialty or non-specialty– specific commodities and state. FSA will update the dashboard every Monday.

Additional USDA disaster assistance information can be found on farmers.gov, including the Disaster Assistance Discovery Tool, Disaster-at-a-Glance fact sheet and Farm Loan Discovery Tool. For FSA and Natural Resources Conservation Service programs, producers should contact their local USDA Service Center. For assistance with a crop insurance claim, producers and landowners should contact their crop insurance agent.