Weekly Cotton Market Review Provided by USDA-AMS

Overview

According to the U.S. Department of Agriculture (USDA) Agricultural Marketing Service (AMS) Cotton and Tobacco Program, spot quotations were 376 points higher than the previous week.

points higher than the previous week.

Quotations for the base quality of cotton (color 41, leaf 4, staple 34, mike 35-36 and 43-49, strength 27.0-28.9, and uniformity 81.0-81.9) in the seven designated markets averaged 109.36 cents per pound for the week ending Thursday, August 11, 2022.

The weekly average was up from 105.60 cents last week and from 88.35 cents reported the corresponding period a year ago.

Daily average quotations ranged from a low of 105.94 cents Monday, August 8 to a season high of 114.80 cents Thursday, August 11. Spot transactions reported in the Daily Spot Cotton Quotations for the week ended August 11 totaled 1,763 bales. This compares to 311 bales reported last week and 1,389 spot transactions reported the corresponding week a year ago.

Total spot transactions for the season were 2,074 bales compared to 3,690 bales the corresponding week a year ago. The ICE October settlement price ended the week at 110.44 cents, compared to 100.12 cents last week.

Textile Mills

Domestic mill buyers inquired for a moderate volume of 2022-crop cotton, color 41, leaf 4, and staple 34 and longer for first quarter through fourth quarter 2023 delivery. No sales were reported. Yarn demand remained good, but mills operated at capacity as allowed by available labor. Mills continued to produce personal protective equipment for frontline workers and consumers.

Demand through export channels was good. Agents throughout the Far East inquired for any discounted styles of cotton.

Trading: West Texas

Spot cotton trading was inactive. Supplies and producer offerings were light. Demand was light. Average local spot prices were higher. Producer interest in forward contracting was light. Trading of CCC-loan equities was inactive. Foreign mill inquiries were light. Logistics continued to be negatively impacted by the COVID-19 Pandemic.

Widespread thundershowers brought up to two and one-half inches of beneficial rainfall. Daytime high temperatures were in the upper 80s to mid-100s. Moderate to heavy rainfall was hit or miss throughout the territory over a period of three days. Some fields in the Panhandle had standing water between the rows. The additional rain helped stands that were blooming and at peak water use. The precipitation came too late for many fields that had reached cut-out. Groundwater supplies remain short, and more moisture is needed to improve water table levels. Yields were expected to be below average. Gin personnel conducted maintenance and repairs on ginning equipment ahead of harvest.

In Case You Haven’t Shut the Water Off…

Kerry Siders, extension agent, integrated pest management, in Cochran, Hockley and Lamb Counties, is concerned that some producers may have a tendency to step up the irrigation toward the end of the growing season or that we may get some late rains.

“We have a lot of cotton that doesn’t have the fruit load to handle that kind of water and it will take back off growing again,” he said. “If that happens, there’s not a thing you can do to stop it. There’s not enough plant growth regulator in the world to stop it, so all it will do is detract from the yield that’s already set in place and hurt the quality of what little cotton we have.

If you’re still irrigating, I would caution you to be careful and always keep an eye on the weather down the road as far as you can, because what little cotton we do have can be undone very quickly. So from an agronomic standpoint, do not pour the coals to it, so-to-speak. It is too late to fertilize, it is too late to compensate with water. Tread lightly.”

NASS and WASDE Reports Released Today

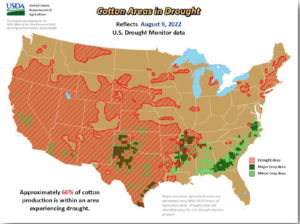

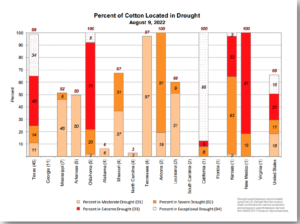

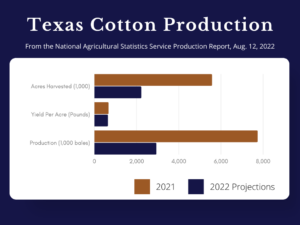

The National Agricultural Statistics Service (NASS) released a crop production report today, saying U.S. cotton production is forecast at 12.6 million 480-pound bales, down 28% from 2021. According to the World Agricultural Supply and Demand Estimates (WASDE) report, this is the lowest production forecast since 2009/2010 — the crop reduced by projected historically high abandonment in the Southwest.

Based on conditions — as of August 1, 2022 — yields are expected to average 846 pounds per harvested acre, up 27 pounds from 2021. Upland cotton production is forecast at 12.2 million bales, down 29% from 2021. All cotton area harvested is forecast at 7.13 million acres, down 31% from 2021.

In this month’s WASDE 2022/2023 U.S. cotton projections, beginning stocks are slightly larger, and a nearly 3-million-bale decrease in production results in lower exports, mill use and ending WASDE-627-5 stocks. Beginning stocks are larger as estimated exports for 2021/2022 are reduced 100,000 bales based on final Export Sales data and Census Bureau data through June.

Exports are projected 2 million bales lower than in July and mill use decreased by 200,000. Ending stocks are 600,000 bales lower, equating to 12.6 percent of expected use — eight percentage points lower than in 2021/22 — and the lowest stock/use ratio since 1924/25. The U.S. season-average price for upland cotton is forecast 2 cents higher this month at 97 cents per pound.